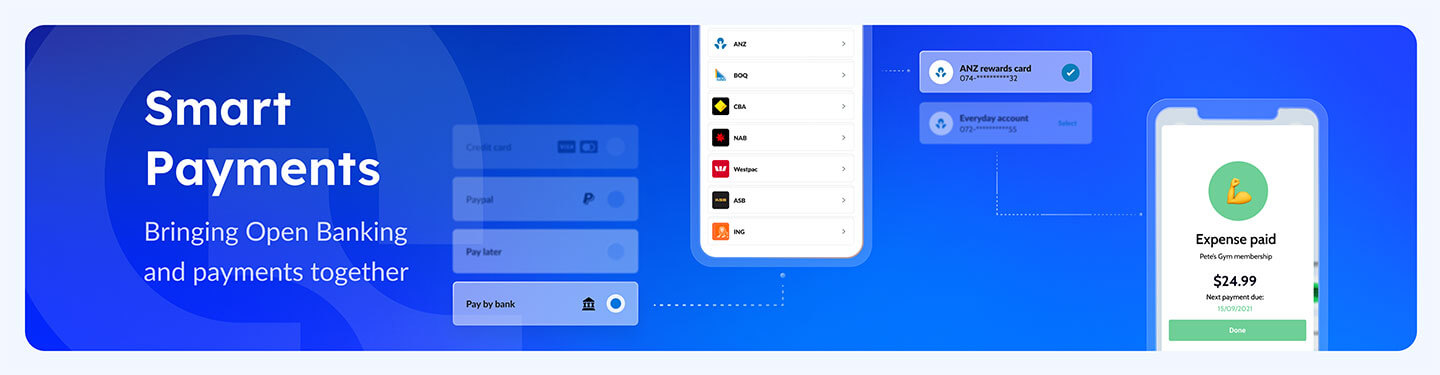

We recently covered the use of direct debit in Australia, highlighting the overlooked downsides of payment failures and their impact on customer churn and operational costs. Read more about it here. In summary, ‘Smart Payments’ offer a more reliable alternative, alleviating concerns.

Collect Payments with Basiq | One platform, one integration

We want to help fintechs bring their products and services to market quickly and efficiently and help them thrive by minimising the risk of payment failure.

Our solution is simple:

Combining data and payment services in a single platform to create the ‘Smart Payment’.

Historically, obtaining financial data and processing payments required engaging with two distinct providers, managing separate integrations, and navigating two consent management flows. This led to a suboptimal customer experience and created obstacles for the development of innovative payment solutions.

Basiq’s introduction of Smart Payments allows for a streamlined collection of funds, avoids many of the hassles associated with processing ‘dumb’ direct debits, and opens a myriad of possibilities for innovation.

What can the Collect API do?

Collect enables:

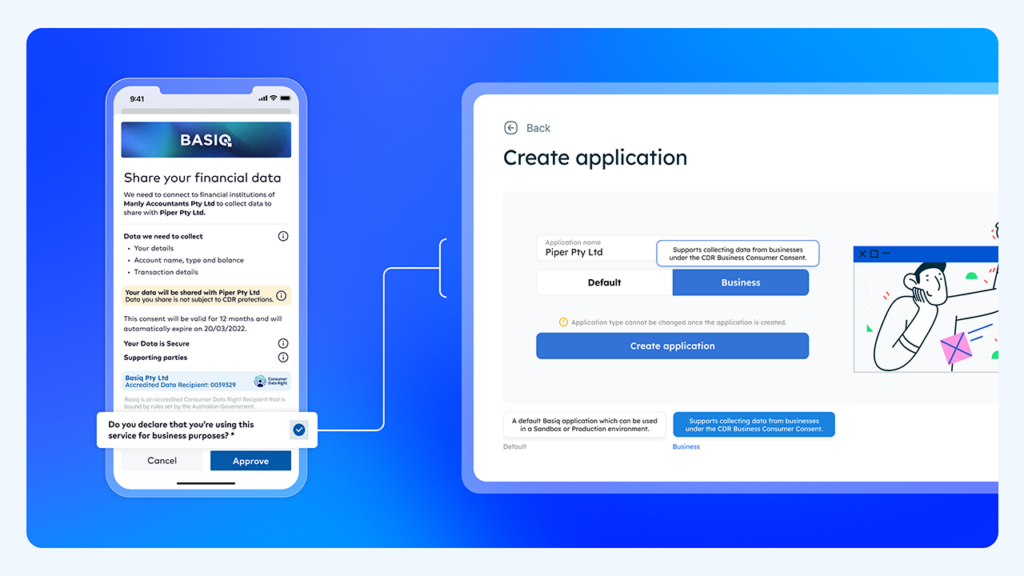

- One-off and recurring payments in real-time via direct debit based engagement and hosted consent;

- Accelerated time to market by saving hours of development and operational costs with our drop-in UI control that facilitates the payment setup;

- Reduced manual input errors with automated capture of account details;

- Enhanced KYC processes to reduce the risk of fraudulent activity with verification of account ownership;

- Decreased number of errors that contribute to failed payments, with Pre-fund checks before executing payments;

- Collection of debit authority and management of data sharing from one convenient place;

- Know when funds have left a user’s account, allowing you to track the reconciliation of funds.

Collect demo

See Collect in action below, via our demo application below. We showcase:

- Capturing consent to share data in addition to collecting consent to execute payments from a nominated account

- Establishing a recurring payment within the application

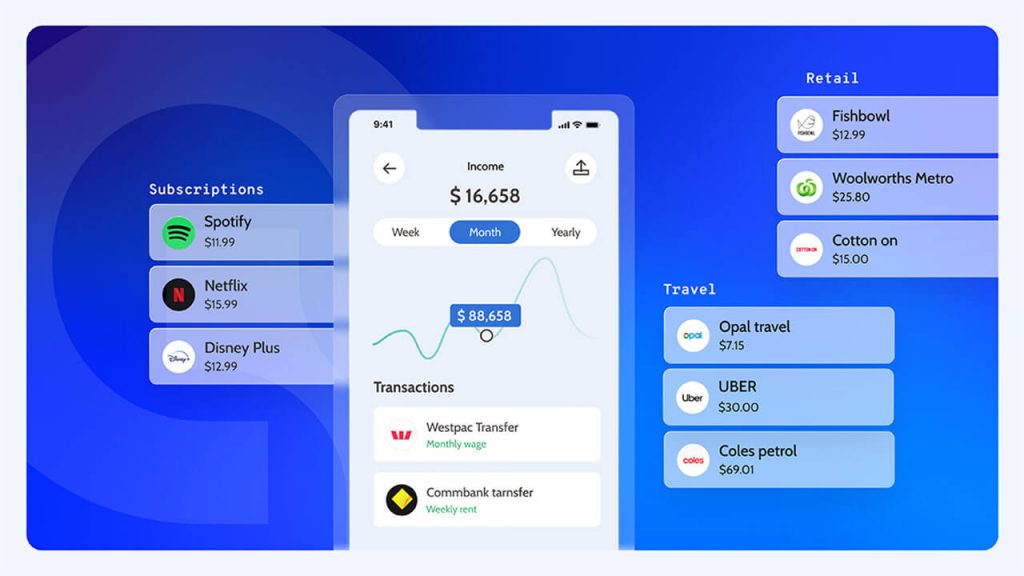

Data has always been our bread and butter and we are constantly adding new sources to help fintechs continue to innovate and improve their user experience. Smart Payments with Basiq allows you to extend and innovate the capabilities of your solution, in the convenience of one platform, with one integration.

Resources

Check out our developer hub for more detailed guides on our Smart Payments products and our API docs if you want to have a play!

If you want to chat, feel free to get in touch with the team to enable payments for your solution.

Article Sources

Basiq mandates its writers to leverage primary sources such as internal data, industry research, white papers, and government data for their content. They also consult with industry professionals for added insights. Rigorous research, review, and fact-checking processes are employed to uphold accuracy and ethical standards, while valuing reader engagement and adopting inclusive language. Continuous updates are made to reflect current financial technology trends. You can delve into the principles we adhere to for ensuring reliable, actionable content in our editorial policy.