Lending

Fast track your lending applications

Accelerate approval times, increase conversion rates and provide seamless customer experiences. Use the Basiq platform to perform account verifications to streamline onboarding, ease the deposit of funds and progress the lending cycle from origination to collections.

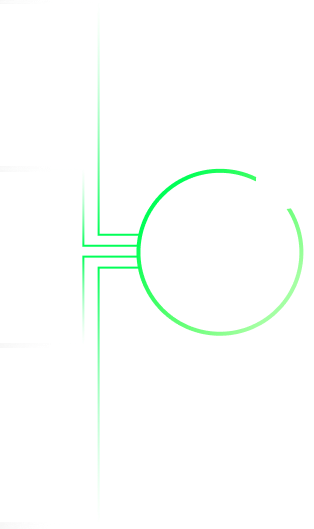

Michael Scott

Male, 51 years

Regional Manager

Dunder Mifflin Inc.

Manly, NSW

Connected Institutions

Summary

-

$8,107 Avg. monthly credits

-

$7,537 Avg. monthly debits

-

Monthly Income $7,929

-

Monthly Expenses $5,911

-

Liabilities $1,228