Quick recap: what’s a direct debit?

A direct debit is an automated and recurring transaction that allows the movement of money from one account to another. To set up a direct debit, consumers must provide their details and complete a Direct Debit Request (DDR) authority form via the business collecting payments from their account.

Direct debits are often used to pay for things like:

- phone, internet and utility bills

- insurance premiums

- rent or mortgage repayments

- memberships (like the gym)

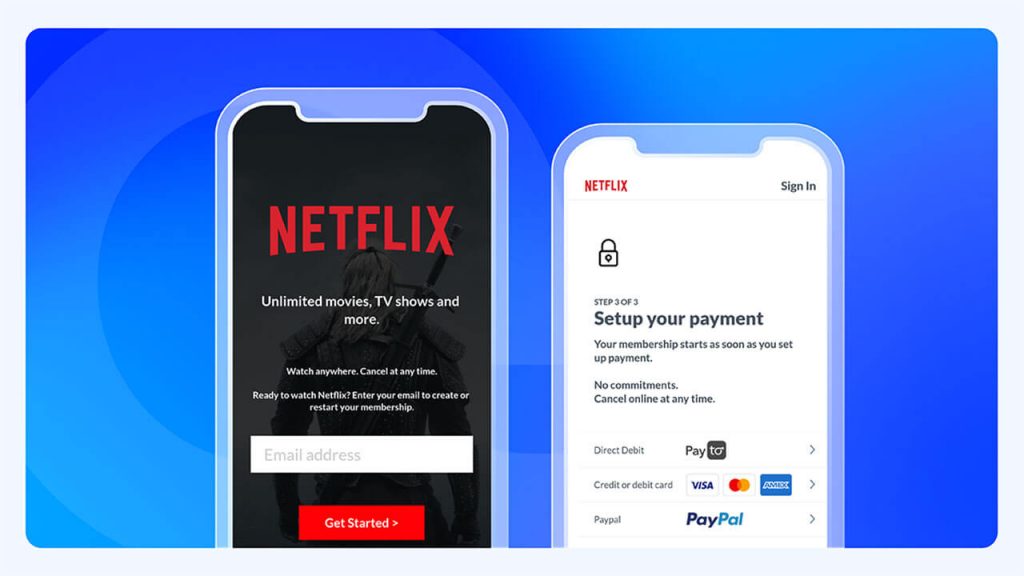

- subscriptions (like Netflix, Spotify, etc.)

Failed payments and the downside to direct debits

In Australia, on average there are over 8 million direct debits processed every month, totalling a transaction value over $361 million.

While they are a trusted and popular form of payment in Australia, there is also a downside for business that is often overlooked; the risk of payment failure.

Failed payments have the potential to increase both customer churn (the ratio of customers lost to customers retained) and operational costs needed to cover dishonour fees, the expense of chasing late payments, and attracting new customers.

The primary causes of failed direct debit payments are:

- insufficient funds: with recurring payments customers are less likely to verify there is enough money in their account.

- human error: account details are entered manually when setting up a direct debit. If any of the details are incorrect, payments are unable to be executed and registered as failed.

The true cost of failed payments

In 2020, the cost of failed payments in the Asia Pacific region was estimated at $43.7 billion. Additionally, the average rate of failure is higher for recurring payments than one off transactions, sitting at 14.6 percent compared to 11.35 percent.

In the current economic environment, we are already seeing consumers change their spending habits to manage the rising cost of living. In this competitive market, there is little room for error and the cost of failed payments to business is high.

A report from GoCardless evaluating the state of payments internationally (including Australia) found that:

- more than half of the 700 payment leaders surveyed said their firm’s revenue and profitability decreased because of failed payments.

- four out of five respondents said it takes their firm more than a month to receive payments and the average days sales outstanding is 20 days or more, impacting cash flow, revenue and company growth.

- failed payments also impacted customer relationships, increasing the risk of bad debt and customer churn.

Improving payment strategies

In the same report, in response to the challenges identified above, respondents recognised the importance of recurring payment solutions as part of their payments strategy. Nearly 60 percent said their firm is planning to invest, or upgrade investment, in recurring payment providers.

Organisations are looking to address customer churn issues by adopting recurring payment solutions to help deliver exceptional service and drive strategic growth. In return they expect numerous benefits, including:

- improved payment success, efficiency, and cash flow,

- customer retention and satisfaction,

- growth and facilitation of international expansion, and

- and meeting compliance requirements.

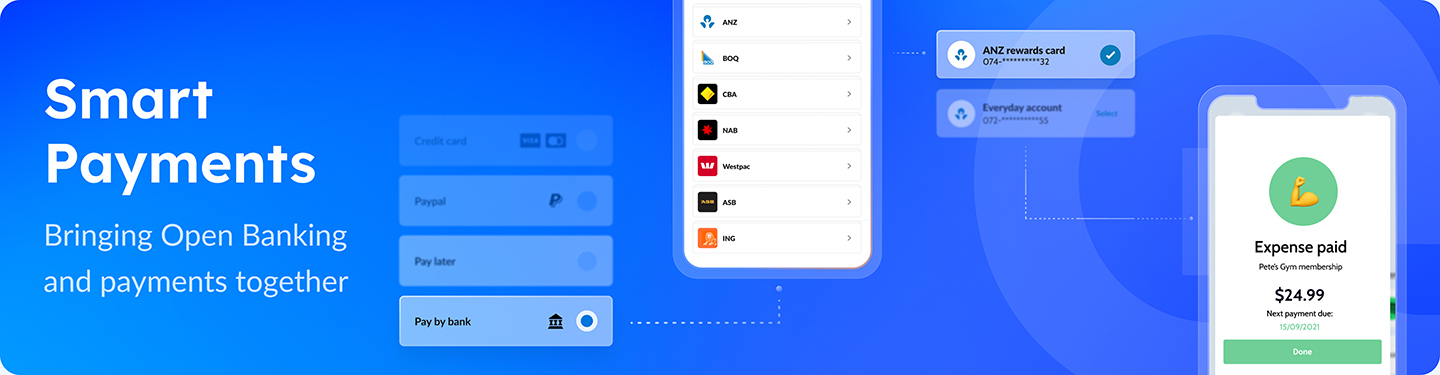

Smart Payments: a new way to pay

We want to help fintechs bring their products and services to market quickly and efficiently, and increase their potential to thrive by minimising the risk of payment failure.

Our solution is simple; combining data and payment services in a single platform to create the ‘Smart Payment’.

The addition of (consented) consumer financial data to payments will provide essential information about a customer’s financial situation that has the potential to:

- decrease the number of errors that contribute to failed payments;

- reduce the risk of fraudulent activity; and

- improve customer experience and reduce churn.

Typically, accessing financial data and executing payments means the use of two different providers, two separate integrations and two consent management flows.

Summary of Smart Payment features and benefits:

Smart Payments will help to remove some of the challenges associated with direct debits and failed payments, saving fintechs time and money, and helping them improve their customer experience.

Summary of Smart Payment features and benefits

| Feature | Benefit | Basiq's Smart Payments | Direct debit |

|---|---|---|---|

| Automated capture of account details | Account details are captured as part of the financial data, reducing errors and mistaken payments | ✅ | ❌ |

| Fraud prevention | Reduces fraudulent payments by confirming account ownership and checking for fraudulent financial history | ✅ | ❌ |

| Check accounts/balance | Reduce errors and payment returns by checking account balances | ✅ | ❌ |

| Smart routing of payments between different accounts | Increases chance of successful payment by ensuring the right account is selected when a payment is made | ✅ | ❌ |

| Automation of payments leveraging financial data | Increases chance of successful payment by determining the best time to make a direct debit based on understanding cash flow | ✅ | ❌ |

| Data and payments consent in one flow | Providing a more friendly user experience that can reduce drop off and accelerate fintech’s time to market | ✅ | ❌ |

| Batch based debits via APIs | Other solutions only do single APIs or files for batch. Basiq has combined these to provide flexibility and a simpler offering | ✅ | ❌ |

Want to find out more about Basiq’s Payments platform? One of our friendly team members would be happy to chat. Get in touch via our contact page.

References

- https://www.rba.gov.au/payments-and-infrastructure/resources/payments-data.html

- https://www.prnewswire.com/news-releases/accuity-study-reveals-failed-payments-cost-the-global-economy-118-5-billion-in-2020–301333385.html

- https://www.spreedly.com/blog/failed-transaction-rates-by-payment-gateways

- https://content.gocardless.com/reduce-failed-payments/forrester-consulting-rethink-your-payment-strategy

Article Sources

Basiq mandates its writers to leverage primary sources such as internal data, industry research, white papers, and government data for their content. They also consult with industry professionals for added insights. Rigorous research, review, and fact-checking processes are employed to uphold accuracy and ethical standards, while valuing reader engagement and adopting inclusive language. Continuous updates are made to reflect current financial technology trends. You can delve into the principles we adhere to for ensuring reliable, actionable content in our editorial policy.