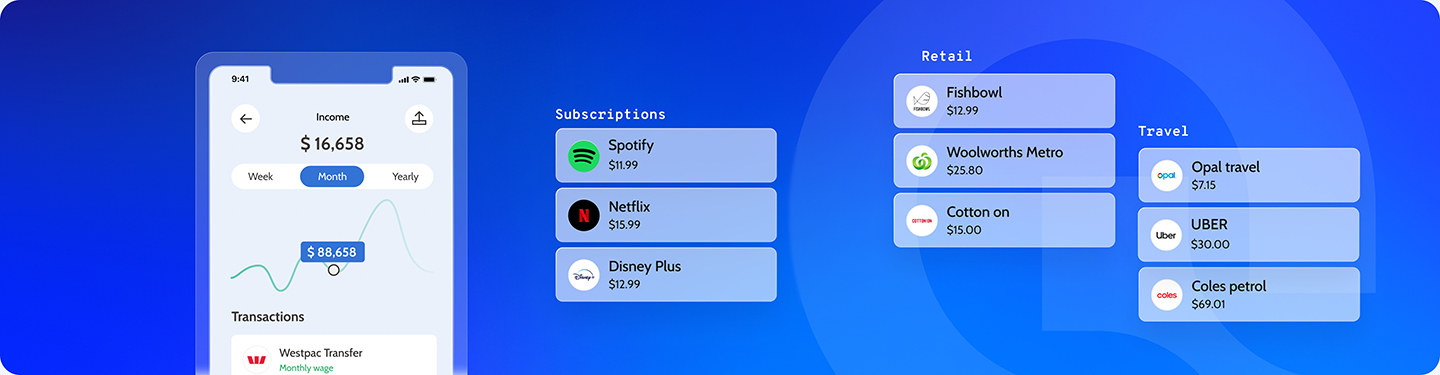

Our powerful categorisation engine takes bank transactions which are typically noisy and difficult to categorise and return a result providing context and accuracy to the data. Use this to gain valuable insights into spending patterns and create better solutions for your customers. Further to this, financial institutions can save on costs arising from answering customer transaction queries via their call-centre.

What is a transaction descriptor?

How often have you discovered mysterious transactions on your statement such as ‘HT Willis Brook’ and sat their in vain trying to work out what and where you spent your precious money. Often transaction details provided by the bank such as date, store name and/or suburb do not provide the necessary clues to where the money was spent. This is what the expense transaction descriptor might look like on a typical statement.

A regular transaction descriptor is made up of many data parts with different information added by banks and merchants. Bank reserved data varies greatly with each bank using different rules. Merchant and location information is often partially complete and can be incorrect.

Evolution of the noisy bank transaction

The Basiq ‘Enhance’ service makes transactions easy to read and provides contextual information which describes each transaction in detail. The service takes noisy bank transactions normalises and enriches them with multiple attributes providing context for the customer.

This is what the journey of the ‘noisy’ bank transaction looks like:

Noise – the service takes the single bank transaction – cleans then normalises it

Context – the powerful engine enriches the single bank transaction with 100+ attributes and currently returns three objects encapsulating many of these attributes:- Category (industry standard categorisation with a 4 level hierarchy)- Entity (merchant or store information) – Location (address and geocode details)

Accuracy – each transaction is analysed using a machine learning model that employs numerous data sources ( 52+) to build confidence and verify output

Insights – enriched bank transactions can then be used to identify patterns and derive valuable insights such as variations in spending or analysis of discretionary versus non-discretionary spend

Use – this financial data allows you to communicate better with your customers and create innovative solutions for verticals such as:- financial strategy and planning- credit decisioning for home loans- personal finance management

If you’re looking to access financial data for your fintech application, get in touch with the Basiq team today.

Article Sources

Basiq mandates its writers to leverage primary sources such as internal data, industry research, white papers, and government data for their content. They also consult with industry professionals for added insights. Rigorous research, review, and fact-checking processes are employed to uphold accuracy and ethical standards, while valuing reader engagement and adopting inclusive language. Continuous updates are made to reflect current financial technology trends. You can delve into the principles we adhere to for ensuring reliable, actionable content in our editorial policy.