Improving lending decisions through tech innovation

Basiq offers a quick and easy way to use Open Banking data to determine a customer’s income – to improve the accuracy and speed of lending decisions.

Lenders want to improve their customers’ loan application experience. By enabling a customer to share their bank transaction data to calculate income – an instant lending decision can be made for credit cards or personal loans.

Income calculation involves more than just taking an applicant at their word. Information provided by applicants is susceptible to overstatement and may not provide a complete picture of long-term financial health.

ASIC has suggested that an applicant’s actual bank transaction data offers a superior source of income calculation.

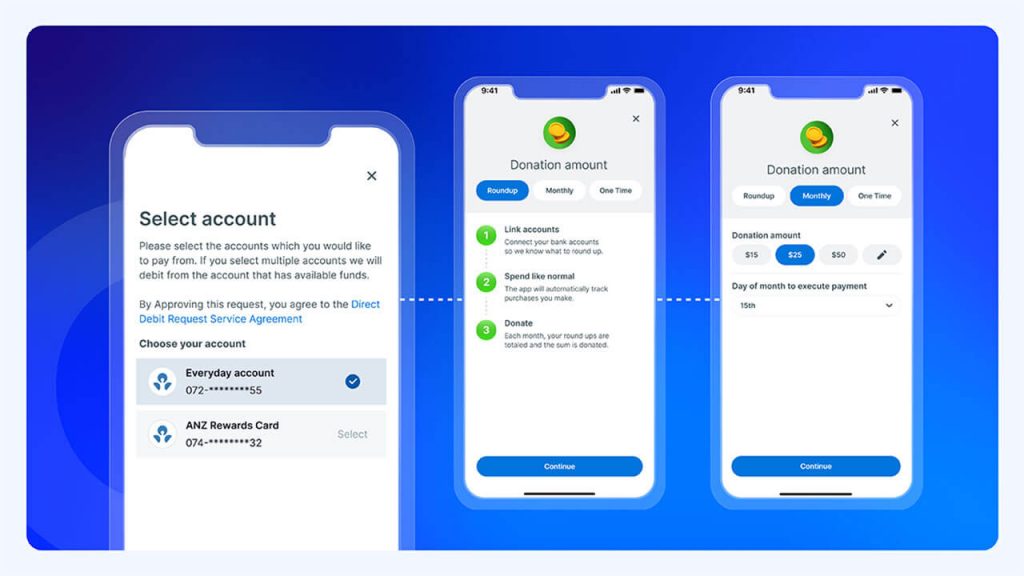

It is simple to embed ‘Basiq Connect’ into a lenders existing loan application process. This allows customers to consent to securely share their bank transaction data. Once a customer has connected to their banks, a lender can use Basiq’s income calculation as part of the automated lending decision.

Depending on the requirements of the loan, the lender can choose how much data to use in calculating a customers income. For a credit card, 90 days of data might be enough. Whereas, for a home loan, it is better to use 13 months of historical bank transaction data.

Basiq’s accurate income calculation across a longer period of time can enable lenders to approve more loans as illustrated below:

An account executive may only have been approved for a $700k mortgage due to a base salary of $130k, even though he regularly makes $150k in income based on his commission cheques. By analysing historical data over the last year, Basiq can help determine that the applicant is actually suitable for a loan more than double the size originally offered.

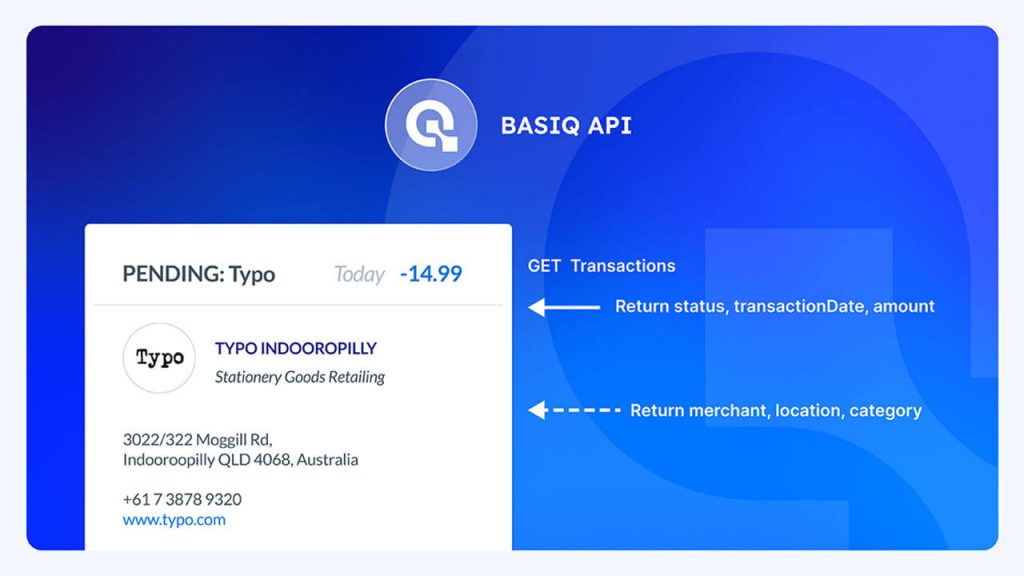

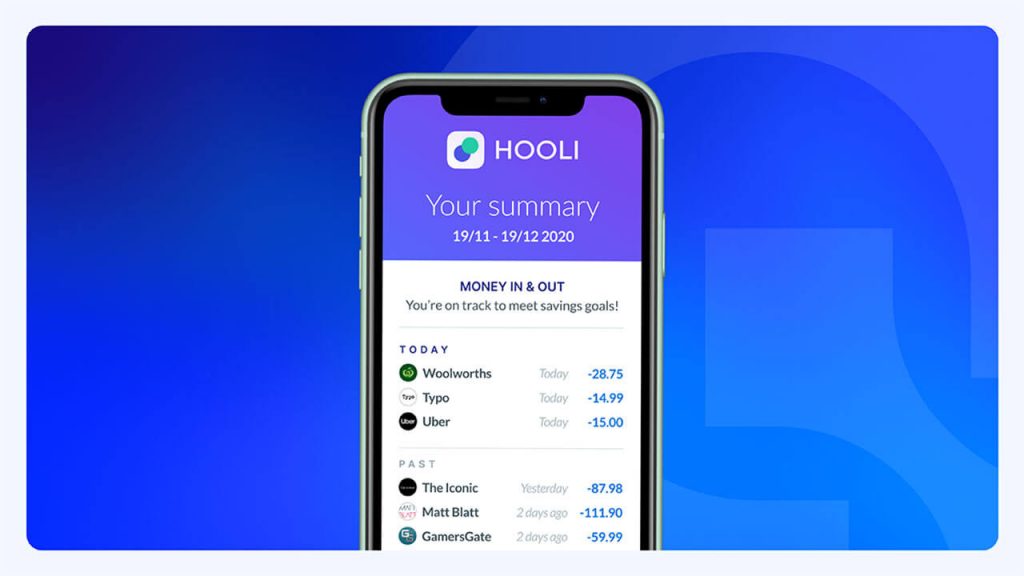

Below is an example of the type of income data that can be provided via the Affordability API. Basiq’s income calculation identifies the income source and whether a customer has reliable income across a specified period of time.

This feature displays the source of income and categorises it according to regularity, making it easy to then identify the type of income and its reliability e.g. Centrelink payment or salary. This provides a full picture across all income types e.g. Centrelink and side income, based on actual credits in accounts.

An example income chart

The Income Summary also includes a chart that categorises fixed and variable income to help further assess the reliability of an applicant’s earnings over a specified period.

How to get the Basiq’s income calculation via the Affordability API

Check out our API docs for the Affordability endpoints and use our sandbox environment for free – contact us to have your API key activated to use live data.

Article Sources

Basiq mandates its writers to leverage primary sources such as internal data, industry research, white papers, and government data for their content. They also consult with industry professionals for added insights. Rigorous research, review, and fact-checking processes are employed to uphold accuracy and ethical standards, while valuing reader engagement and adopting inclusive language. Continuous updates are made to reflect current financial technology trends. You can delve into the principles we adhere to for ensuring reliable, actionable content in our editorial policy.