Getting granular with expense categorisation

We find that every lender has different requirements for how they use living expenses to assist with lending decisions. We know that using a benchmark like HEM is no longer good enough. Some lenders categorise their customer’s living expenses using LIXI, HEC (Household Expenditure Classification), or their own custom definition of discretionary versus non-discretionary spend.

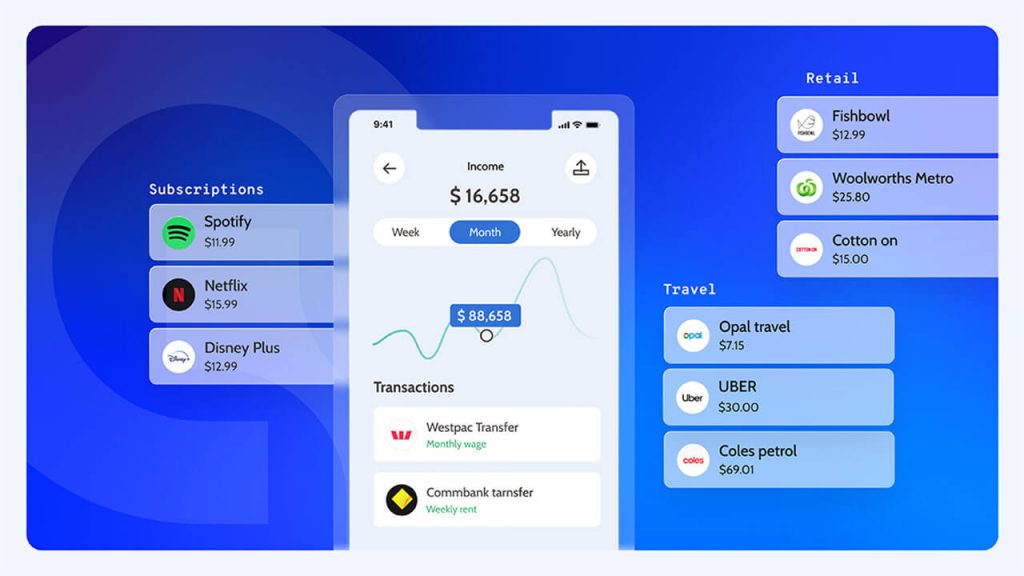

Basiq derives a customers living expenses based on bank transaction data from over 65 financial institutions in Australia and New Zealand. In particular, the affordability report provides a full financial picture of where a customer spends their money across all of their banking institutions.

Basiq’s living expense categorisation uses the ABS (Australia Bureau of Statistics) and Stats NZ (Statistics New Zealand) classification to ensure reliability and compatibility with national standards. With this categorisation Basiq provides a granular level of detail from up to 700 categories with 95% accuracy. This level of detail means categorisation can be easily mapped to custom categories and tailored to suit a wide variety of use cases beyond standard categories.

A practical example of a loan applicants expenditure

For example, data can be custom mapped to discretionary and non-discretionary categories to help identify an applicant’s ability to reduce their expenditure and repay a loan.

This can be seen in Basiq’s Affordability report which can display the ratio of discretionary versus non-discretionary expenditure.

An applicant spending 50% of their income on basics and another 27% on discretionary items has far less capacity to save when compared to the below individual who is only spending 30% on basics and 47% on non-essentials.

Both individuals have around 23% of their income left to repay debts or save, yet the first applicant will find it significantly harder to reduce expenditure to accommodate a loan.

Beyond this, it is also possible to tailor the categorisation to a range of data standards and customer bases. In lending and mortgage processing LIXI is considered the data standard. Because Basiq’s categorisation is so detailed it is easy for LIXI licensees to categorise data according to LIXI standards and keep up with any changes.

Custom categories are also important when it comes to areas like alternative lending and auto financing, where the customer base is more specific. For these customers, there may be different insights and concerns that need clarifying. Not only can Basiq categorisation be mapped to relevant custom categories for custom insights, it makes it possible to gain both a high-level understanding of customer spend and a more in-depth view when necessary.

With this system of categorisation, Basiq has the capability to benchmark an individual’s expenses e.g. against other individuals with similar demographics. Currently, we are working on adding benchmark numbers to our Affordability report so it is possible to understand how an individuals expenditure compares to others of a similar demographic and location.

Additionally, the granular nature of having 700 categories means we can monitor our model performance accurately. This ensures that as data continually shifts and changes Basiq’s categorisation models remain the best in the market in terms of coverage and accuracy.

To take advantage of our categorisation today, get in touch with the Basiq team

Article Sources

Basiq mandates its writers to leverage primary sources such as internal data, industry research, white papers, and government data for their content. They also consult with industry professionals for added insights. Rigorous research, review, and fact-checking processes are employed to uphold accuracy and ethical standards, while valuing reader engagement and adopting inclusive language. Continuous updates are made to reflect current financial technology trends. You can delve into the principles we adhere to for ensuring reliable, actionable content in our editorial policy.