Accessing Open Banking data

It’s the next step in Basiq’s journey in enabling our partners to access CDR data in February, under the Principal/Representative and Sponsorship/Affiliate models proposed by Treasury and the ACCC.

What does this mean for our partners?

We’re excited to announce that the Basiq platform has been upgraded in preparation for Open Banking!

While other providers of Open Banking services can connect you to the data, they leave you to manage the more complex areas of CDR.

Basiq takes the complexity away by providing services which includes:

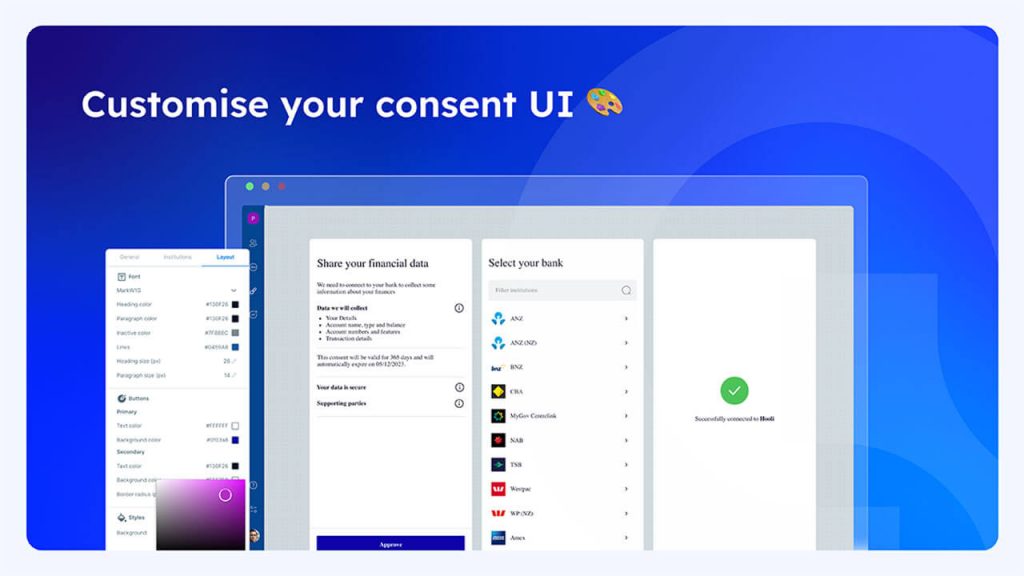

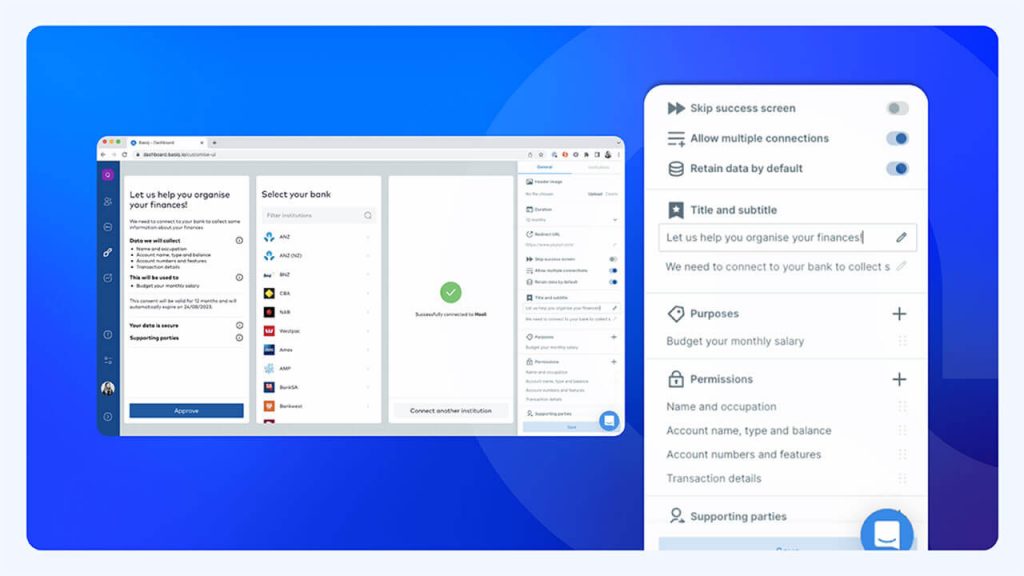

- Consent definition

- Secure registration and interaction with the CDR register and its data holders

- Retrieval and enrichment of the raw CDR data

- Data governance requirements and so much more!

Basiq is stripping out the complexity of having to deal with costly accreditation processes and building out CDR compliant infrastructure. Providing an all inclusive managed solution that saves our partners months of technical engineering, planning time and cost so they can focus on building value for their end users.

We are excited to simplify access to open banking data through our powerful single unified API and have this as an additional source of data alongside existing data sources, enabling our partners to get an even better understanding of their consumers’ financial picture.

Be Open Banking ready with Basiq

As Open Banking continues to mature, the use of both Open Banking data and Digital Data Capture will be necessary in order to maximise data coverage

We don’t want our partners at Basiq to worry about the data sources, our focus is on enabling you to to focus on the value you can get from the data. Our single unified API is so powerful in being able to deliver data to you regardless of the source being Open Banking or DDC.

Open Banking solution

From February we will be launching our partner access solution, enabling our partners to access CDR ‘Open Banking’ data through Basiq’s single unified API.

Based on the proposed models from Treasury and the ACCC, Basiq will be supporting our partners with the CDR Principle/Representative and Sponsorship/ Affiliate models.

For more information on our access solution please feel free to get in touch to chat about next steps!

Open Banking APIs

As we get ready to provide our partners access to Open Banking data in February with our new access solution, we have been busily preparing our new Open Banking API connectors so our partners will be ready to begin building and integrating Open Banking data into their solution.

Take a sneak peek ? at the draft API docs below!

Still unsure on how you’ll transition to Open Banking? Check out our ‘Practical guide to transitioning to Open Banking’ for further details on what you can expect and things to take into consideration.

If you still have questions, get in touch with the team and stay tuned for more updates on Basiq and Open Banking.

Article Sources

Basiq mandates its writers to leverage primary sources such as internal data, industry research, white papers, and government data for their content. They also consult with industry professionals for added insights. Rigorous research, review, and fact-checking processes are employed to uphold accuracy and ethical standards, while valuing reader engagement and adopting inclusive language. Continuous updates are made to reflect current financial technology trends. You can delve into the principles we adhere to for ensuring reliable, actionable content in our editorial policy.