Introduction

Welcome back to Instalment 8 of the Basiq Insights series. This edition turns to a trend that is taking Generation Z and Generation Alpha by storm – that is, using TikTok as a platform to increase financial education and literacy. We argue that the uptake of Open Banking could be rapidly accelerated within this audience through: (a) education on what Open Banking is by ‘Finfluencers’ (finance influencers) who are prominent in the financial literacy and education space on TikTok and (b) allowing said Finfluencers to provide innovative B2C financial literacy solutions building atop Open Banking infrastructure. Given Gen Z will be the largest cohort for Open Banking data sharing in the future, there’s no better time to explore what this could look like.

NB: Basiq supports the term Finfluencer when applied to increasing a user’s financial literacy and education – not ‘pump and dump’ schemes, advice that breaches the Corporation Act, conflicts of interest or market manipulation, as outlined by the ACCC.

TikTok 101

TikTok is the viral social media platform taking Gen Z by storm. The video-only social platform hosts a range of short-form videos from 15 seconds to three minutes, covering anything – from comedy and dance trends to education (and possibly all three combined). Roughly 2.5m Aussies use the platform monthly, with 70% of users comprising Gen Z or Generation Alpha (2). Australians spend an average of 16.8 hours per month on the platform, recently nudging ahead of YouTube. See below from Roy Morgan:

The video-only platform encourages users to discover content that the algorithm thinks they will like, and rapidly learns about their interests as time spent on the app increases.

Unlike Facebook and Instagram, which rely on a ‘Social Graph’ to power the content served to its users (aka interests from people in your friendship and social circles fuelling the algorithm), TikTok works via an ‘Interest Graph’. So, instead of seeing things your friends like, content is served up based on what other people like you are interested in (aka you don’t need a big friend list, and a lot of the content you see is from people you don’t know), what’s trending and what’s ‘For You’ – content that TikTok thinks you’ll like. (note social graphs aren’t always mutually exclusive – you can learn more about the algorithm here).

So, you keep watching videos about golden retrievers, Bitcoin and cricket? No worries, here’s a bunch of videos that people who also like golden retrievers, Bitcoin and cricket are interested in. This also extends into micro-communities, whereby clusters of people share an interest in similar things – such as those who are over thirty and use the hashtag #over30stiktok.

TikTok’s high engagement rates are a testament to how well it is the curator of infinitely-scrolling video engorgement for its users. So how does it apply to Open Banking?

The Open Banking context

One of the biggest questions behind Open Banking is to do with consumer uptake. Namely, how do we ensure consumers understand what data they are consenting to sharing and for what purpose? At its highest level, this comes down to providing accessibility to financial products and while educating end users on the extremely well thought-out security measures in place under the regime. According to the UK’s Open Banking Implementation Entity(OBIE), this has been a rampart to change:

“…only 3 million people were using Open Banking at the start of 2021. In part, this will be due to low levels of consumer understanding but progress was also hampered by a lack of compelling Open Banking products.” (1)

We can see there is a Catch-22 here for uptake – people don’t want to share data because there is a lack of compelling Open Banking products, but Open Banking data products are not being created due to a low level understanding. Can TikTok’s microcommunities and Finfluencer’s solve for this? We think yes…

TikTok + Open Banking

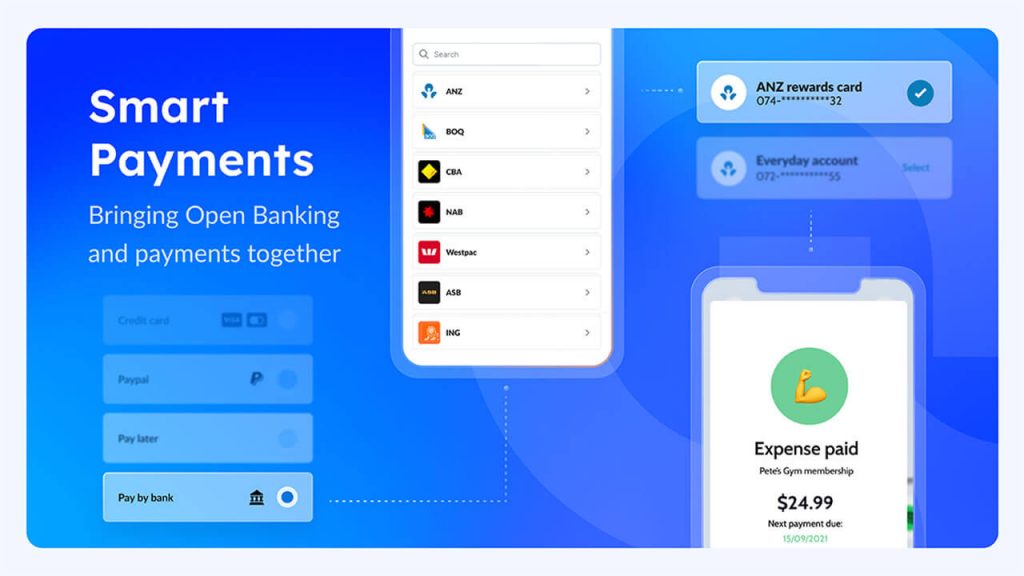

Given that Gen Z are the future of finance, Open Banking and the Consumer Data Right (CDR) should increase their presence in the realm of the Finfluencer, in order to encourage the ‘so what’ behind its purpose. Account switching and product / service comparison are use cases that are often referenced by people in the Banking and finance space, but they are still highly product driven (account opening and product sale respectively) – TikTok can provide an education-driven approach.

Finfluencers have generated a way to distil financial messages in a novel format – heavily content-driven and educationally-driven manner. This is the sort of use cases that should be celebrated, promoted and revered as a way to drive adoption and comfortability with Open Banking and CDR.

Ultimately, Finfluencers can educate their massive communities on the benefits of using Open Banking data to help with their financial lives. We are already seeing it in financial services – see a screenshot below on the #moneytok community – complete with 9.4 billion views – so why not for #openbanking?

You’ll notice TikTok adds in a disclaimer on how to mitigate risks on financial advice (not the scope of this document), following a ban on advertising financial products or services.

Financial literacy over financial products

Using TikTok to push financial products as an unlicensed advisor is undoubtedly a risky and difficult-to-regulate area. Thankfully both regulation (the ACCC) and TikTok are taking the right steps to prevent unlawful advice that could result in significant damage or lead to hardship. Senator Jane Hume has commented on the Finfluencer phenomenon (4):

“It goes without saying that if you make a financial decision that goes drastically wrong based on the musing of a taxi driver or a guy down at the pub or a 16-year-old on TikTok, it shouldn’t be up to the government or indeed the industry to bail you out.”

According to research by MLC, we can see how this is a real issue for the platform and policy alike, outlining: “13 percent of Aussies aged between 18 and 34 are regularly using platforms such as TikTok, Facebook and Instagram as a financial resource.” (5)

Undoubtedly, drawing the line between ‘financial literacy’ over ‘financial products’ is incredibly important, however it’s important not to stifle the former with the latter. There is a golden opportunity to increase Open Banking’s uptake using education on TikTok, while also see the benefits of education-driven Finfluencers – because it’s already happening.

Financial literacy over financial products

There’s a lot to be admired about Gen Z and the future of finance. I never thought I’d use the words TikTok and Open Banking in the same sentence, but if CDR and Open Banking can effectively leverage TikTok – in the same way the NSW Govt did to mitigate COVID-19 misinformation – there’s a completely new way to market the benefits of Open Banking to encourage its future success.

References

- https://www.altfi.com/companies/open-banking-implementation-entity

- http://www.roymorgan.com/findings/8538-launch-of-tiktok-in-australia-june-2020-202010120023

- https://themusicnetwork.com/tiktok-youtube-australia/

- https://www.ifa.com.au/news/30110-hume-says-policing-tiktok-advice-would-inhibit-innovation-progress

- https://www.nestegg.com.au/invest-money/aussies-turn-to-tiktok-following-covid-19-downturn

Article Sources

Basiq mandates its writers to leverage primary sources such as internal data, industry research, white papers, and government data for their content. They also consult with industry professionals for added insights. Rigorous research, review, and fact-checking processes are employed to uphold accuracy and ethical standards, while valuing reader engagement and adopting inclusive language. Continuous updates are made to reflect current financial technology trends. You can delve into the principles we adhere to for ensuring reliable, actionable content in our editorial policy.