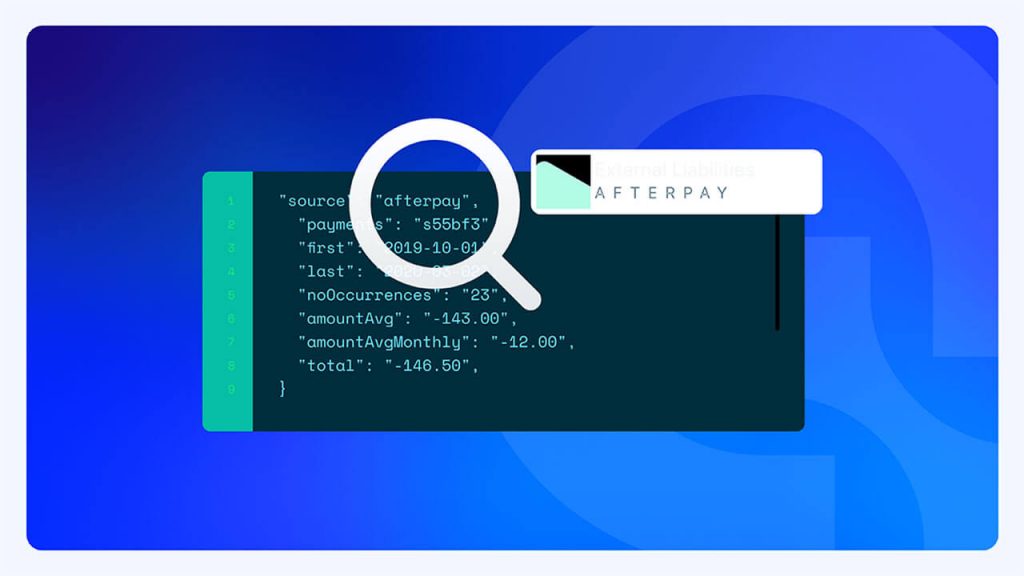

Basiq is open for payments! Our Collect API was the first in our suite of payments products allowing customers to securely access powerful data insights and execute payments via a single platform. Coined as ‘Smart Payments’, Collect was the first step in being able to execute one-off and recurring payments in real-time via direct debit based engagement and hosted consent.

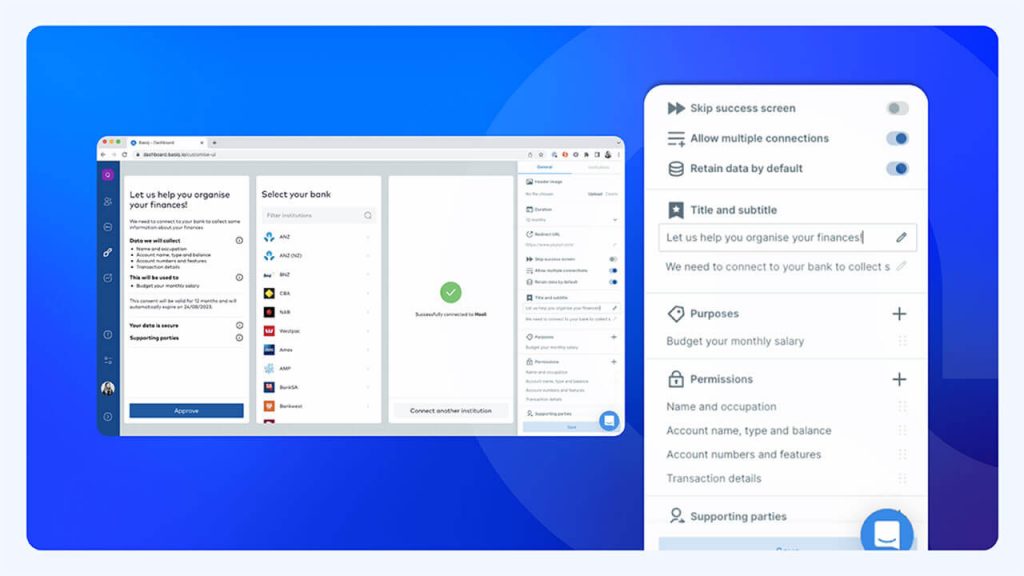

Accelerate time to market with Basiq’s consent UI solution

Basiq’s drop in UI control allows customers using collect to capture debit authority consent and data sharing consent in one convenient onboarding flow. Accelerating time to market whilst also saving hours of development and operational costs. See the full write up of the collect API and its features here.

Send has entered the chat

Collecting consent to facilitate debit payments is step one, now you can Send it with Basiq payments. Send gives customers the ability to pay out funds to their customers or suppliers directly from the Basiq platform in real-time.

Utilise a float account to pay out funds to external bank accounts in real-time and keep this float account funded by having debits automatically settle here to be paid out, or manually top it up with one off payments or auto-top ups to ensure efficient funds for payouts.

What can you do with Send?

Our Send API enables you to:

- Reconcile and deposit a user’s funds with ease. Previously a slow, bulk batched process, customers now have the ability to manage individual withdrawals and payments in real-time.

- Reduce costs and improve the speed of funds arriving to users or third party suppliers directly. Customers have control to send funds any way they like, whether it’s fast, bulk batched or a combination of both e.g. the payout will first be attempted to be sent over the fast/real-time network and if a failure occurs (e.g. the recipient bank and/or account is not enabled for fast/real-time) then the payout will be sent as a bulk batched payment.

- Always stay in the know on the success or failure of your payouts, with the ability to regularly call and track payments via the API endpoint.

For more details on Send and the rest of the Basiq payment suite of products, check out our developer hub and API docs.

Article Sources

Basiq mandates its writers to leverage primary sources such as internal data, industry research, white papers, and government data for their content. They also consult with industry professionals for added insights. Rigorous research, review, and fact-checking processes are employed to uphold accuracy and ethical standards, while valuing reader engagement and adopting inclusive language. Continuous updates are made to reflect current financial technology trends. You can delve into the principles we adhere to for ensuring reliable, actionable content in our editorial policy.