Trust accounts are a fundamental vehicle for individuals and organisations to safeguard and manage assets for designated beneficiaries. They play a vital role in protecting assets and ensuring their proper distribution, a common practice in industries such as medicine and law, as well as in charities, estate planning, and investments.

The challenges of reconciling Trust accounts

The reconciliation of trust accounts involves collating data from various sources including bank statements, client records, and internal systems. Consolidating and reconciling data from these disparate sources is a labour-intensive process.

It can involve requesting and uploading bank statements and meticulously matching transactions, a tedious process that consumes valuable time and resources. As a result, it can be prone to inefficiency and errors which can jeopardise the integrity of the trust and expose it to the risk of misappropriation.

Using Open Banking

Open Banking provides an avenue to optimise the trust account reconciliation process by enabling access to real-time data from banks.

1. Save time and money

Say goodbye to manual requests and uploads. Open Banking facilitates swift access to real-time banking data, eliminating cumbersome paperwork and expediting the reconciliation process. By automating routine tasks, financial professionals can focus on value-added activities, saving time and reducing costs.

2. Streamlined access

Navigate multiple consent flows with ease. Open Banking offers a unified method for accessing banking data from various accounts, simplifying workflows and enhancing convenience. With just one consent, financial professionals can access a wealth of information, making trust account management more efficient, especially when ongoing access to banking data is possible.

3. Easily spot irregularities

Access to real-time banking data means the process of identifying discrepancies becomes straightforward. Whether it’s an outlier transaction or a mismatched entry, ensuring accuracy and compliance is a straightforward process.

4. Data insights

Access to real-time banking data through Open Banking allows for data-driven insights that can inform strategic decision-making. Financial professionals can analyse trends, identify patterns, and make informed decisions to optimise trust account management strategies.

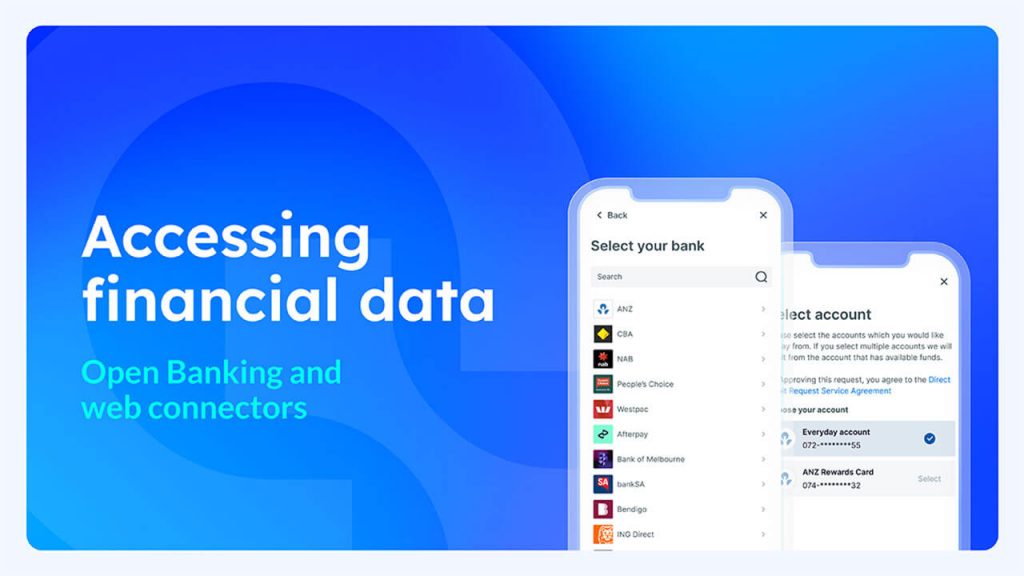

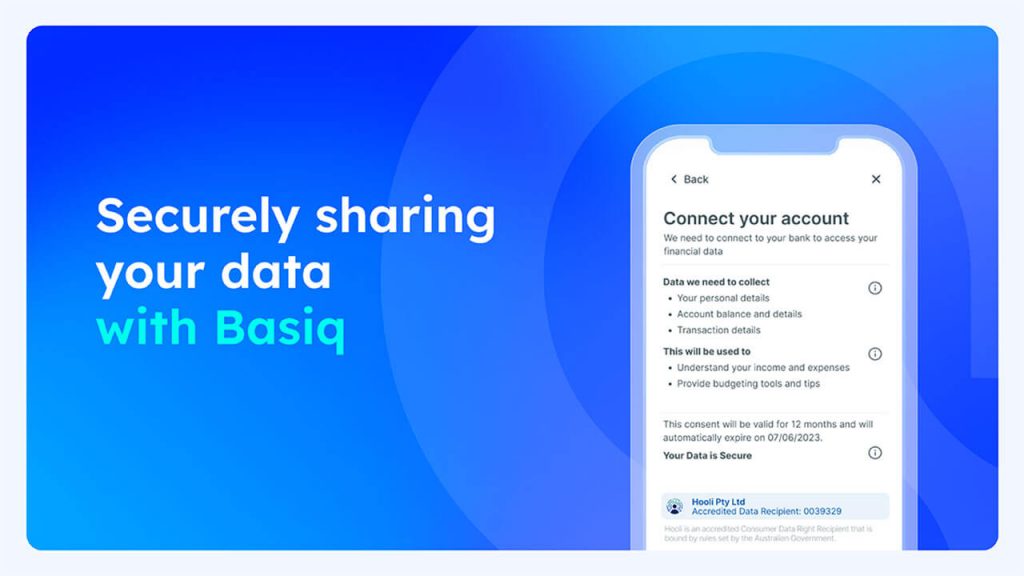

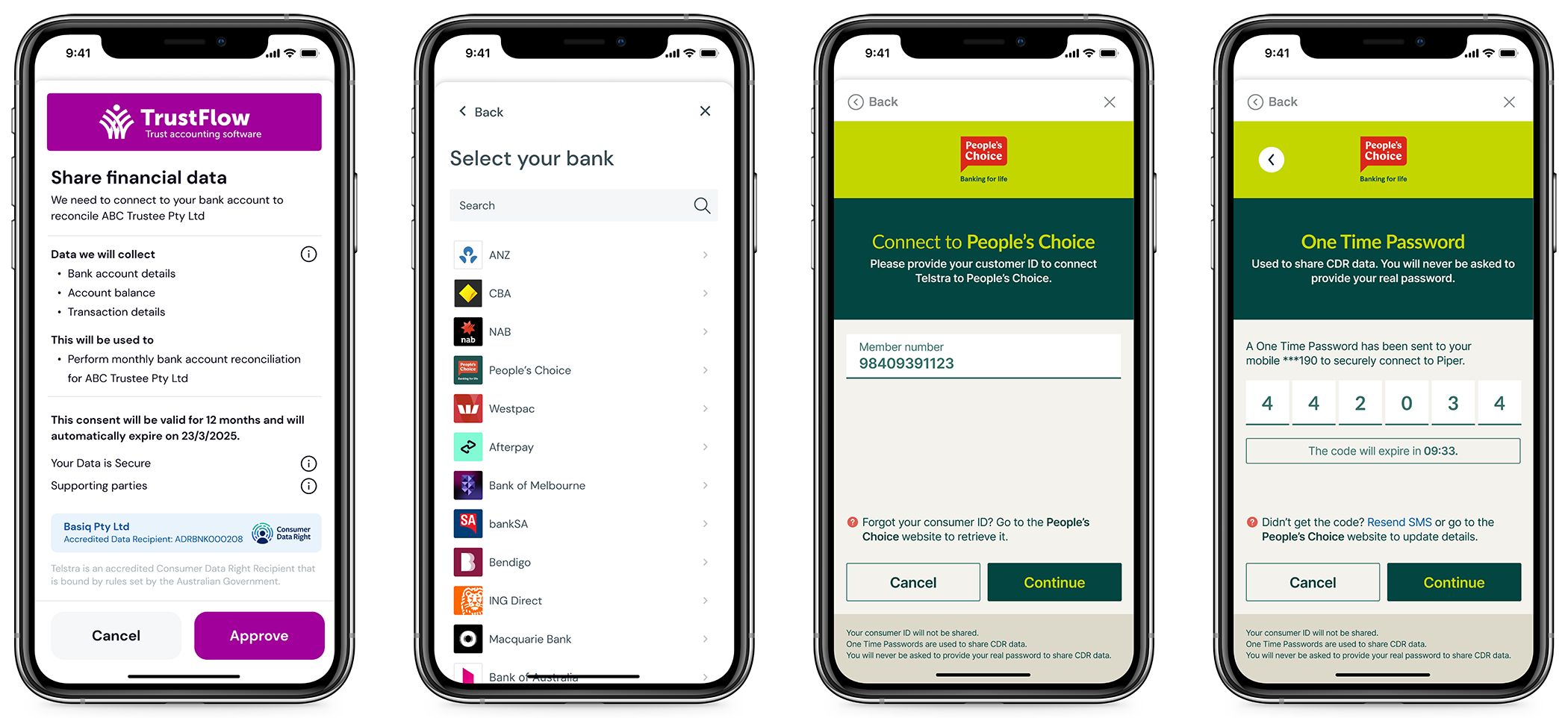

Accessing Open Banking with Basiq

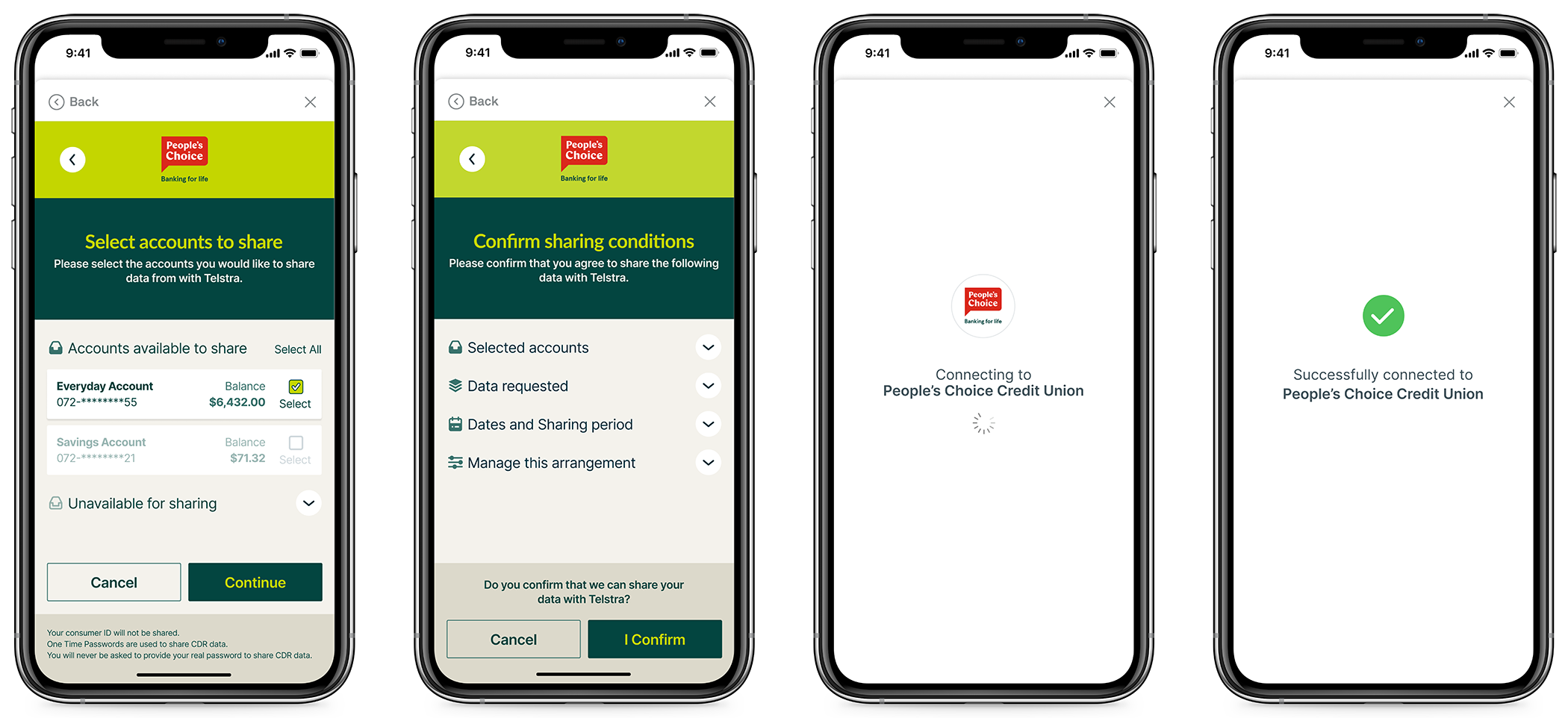

Accessing Open Banking via the CDR is a straightforward process where the owner of the bank account consents to their data being shared. The user is redirected to their respective bank to login via their Internet banking portal.

Once the respective bank account is selected the data can be shared with ERP systems, accounting software and specific trust accounting software to optimise the reconciliation process.

Learn more about Open Banking

If you’re keen to learn more about Open Banking, check out Basiq’s Open Banking Hub or get in touch with our friendly team!