Intro

Welcome to Week 3 of the Basiq Insights series. Last week, we looked at how Banks are reacting to the threat of Fintechs – either beating them or joining them. This edition looks at another industry-wide trend: the shift away from credit cards to both debit and BNPL. We’ll have a look at the Australian BNPL landscape, the proliferation of BNPL in Australia, changing consumer expectations, the rise of debit and some of the regulatory headwinds making way for the BNPL industry.

BNPL in Australia

Afterpay and Zip are the household BNPL names. Many companies since their inception have sought to emulate their success – either focusing on a specific vertical (yes, you can even BNPL your school fees) or trying to eat up market share outside of retail. As is typical with industry growth, the massive demand of BNPL led to a proliferation of products – so much so you can now BNPL pretty much anything – including Payo’s ‘Eat Now Pay Later‘ at your favourite restaurants, Deferit’s BNPL bill payments and BNPL construction loans.

The growth in this sector has been phenomenal – driven by Millennials’ and Gen Z’ love for BNPL services – as the BNPL service providers ability to completely remove the need for a credit card or a Bank relationship through a simple to understand and frictionelss experience. Here’s a snapshot of the inputs on some of the ways the experience changes between a credit card and a BNPL provider:

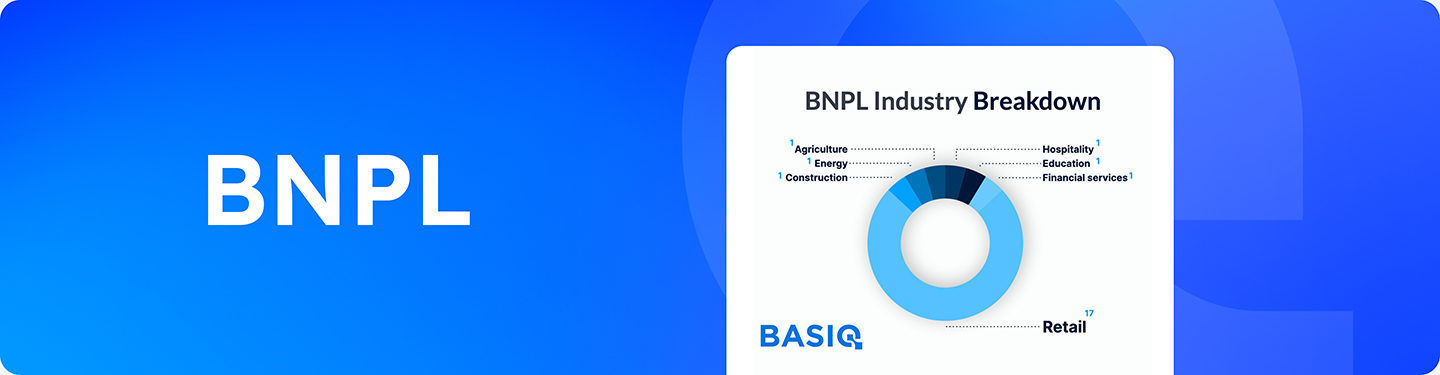

In 2020, the total value of BNPL transactions exceeded $9bn1 . What the segment has proven is that its not a one size fits all, and that there is enough space for multiple parties to operate within. Here’s a lay of the BNPL land, broken down by industry vertical, consumer or business facing and employee count.

One of the most exciting insights from this is that over 50% of BNPL providers are listed signaling two things: (a) there’s massive demand from both consumers and investors in the area, and (b) BNPL companies prefer to IPO in order to make the most of this interest. Figure 3 below reiterates the spread of BNPL across multiple industries, not just retail:

The Gen Z Experience

BNPL has become synonymous with a Millennial audience, yet really I think the commentary should focus more on Gen Z (I actually think Gen Z are vastly underrepresented in the media when it comes to Fintech2, when they are the most progressive and tech savvy age group – but that’s for a later Insights edition). See the illustrative Fig 4 below from Mozo:

As Gen Z booms, the demand will continue to increase (Gen Z is anyone from 6 – 24, and only those above 18 are allowed to use BNPL services).

Regulatory challenges of BNPL

BNPL regulation is polarising in the financial services industry – the Fintech argument is commonly that regulation will stifle innovation, whereas the Banks argue that BNPL should be regulated like other credit products (and it shows why CBA insists on a credit check for both Klarna and their own BNPL product). CBA’s Matt Comyn argues that because BNPL is getting so big, “the time for BNPL regulation has arrived”3, specifically calling for BNPLs to report repayment behaviour to credit bureaus so that Banks can better determine lending risk. By definition, BNPL exists outside of the National Credit Code(3), namely due to the definition of credit requiring interest repayments. Given BNPL makes money from both the merchant and the customer (late fees…and in some cases interchange fees) – it doesn’t incur the same regulation that a traditional credit product does. Although this means that technically there are fewer protections offered to customers than a personal loan or credit card – these are often outweighed by a great customer experience and brand loyalty.

In 2021, Australian BNPL companies joined together for an industry ‘self-regulation’, following fairly light-on recommendations by ASIC suggesting limited intervention into the space6. The self regulation encouraged was aimed at responsible lending practices to prevent consumers over extending their BNPL debts – such as opening multiple BNPL accounts with multiple providers. In 2020, ASIC found that 55% of customers had more than one BNPL debt with more than one provider7.

Give Credit Debit

RBA data shows that debit cards are continually on the rise, supporting the argument that it isn’t just BNPL that’s affecting credit, but a trend away from credit to debit8. There’s a number of inputs to this aside from just BNPL – (a) card acceptance and digital wallets – allowing for less friction (e.g. Apple Pay) at point of sale (b) low interest rate environment – money is increasingly liquid and there’s not much attractive about savings rates at the moment (c) the rise of ecommerce and online spending (especially in pandemic-ridden 2020) (d) ‘responsible spending’ – whereby people are much more conscious of how and where to spend their money (which ties in with the move away from credit) (e) the demise of cash. With this in mind, it’s important to clarify that both debit and BNPL are the credit card killers – not just BNPL alone. BNPL is riskier though, and one thing in particular is multiple BNPL debts.

Today I Learned

Before we wrap up, I thought I’d share this: the thing about a debit card is that etymologically; debit means owed, when really it is your money and you don’t owe anything. It’s always confused me that a debit card is more like a credit card (e.g. your own credit), than a credit card is (e.g. your debt). I think it’s indicative of how Banking language historically makes sense to Banks, but not so much consumers, and Fintechs play a critical role in removing the information asymmetry and makes Finance an enjoyable experience. I did some googling and this is because you are debiting your own account (which is painfully obvious in retrospect).

That’s all for the latest edition of Basiq Insights. We hope that provided a solid insight into the BNPL market, the trend away from credit cards to debit and most importantly, the potential regulation coming to the BNPL market.

References / Supported Reading

- https://www.rba.gov.au/publications/bulletin/2021/mar/developments-in-the-buy-now-pay-later-market.html

- https://www.smh.com.au/business/banking-and-finance/tech-savvy-disloyal-and-debt-shy-banking-s-battle-for-the-young-heats-up-20210520-p57tqz.html

- https://www.afr.com/companies/financial-services/time-for-bnpl-regulation-has-arrived-comyn-20210415-p57jgg

- https://www.legislation.gov.au/Details/C2017C00196

- https://www.smh.com.au/business/banking-and-finance/booming-buy-now-pay-later-sector-defends-self-regulation-20210226-p57687.html

- https://asic.gov.au/about-asic/news-centre/find-a-media-release/2020-releases/20-280mr-asic-releases-latest-data-on-buy-now-pay-later-industry/

- https://asic.gov.au/about-asic/news-centre/find-a-media-release/2020-releases/20-280mr-asic-releases-latest-data-on-buy-now-pay-later-industry/

- https://www.rba.gov.au/payments-and-infrastructure/resources/payments-data.html

Article Sources

Basiq mandates its writers to leverage primary sources such as internal data, industry research, white papers, and government data for their content. They also consult with industry professionals for added insights. Rigorous research, review, and fact-checking processes are employed to uphold accuracy and ethical standards, while valuing reader engagement and adopting inclusive language. Continuous updates are made to reflect current financial technology trends. You can delve into the principles we adhere to for ensuring reliable, actionable content in our editorial policy.