Introduction

Property Technology, or Proptech, is gaining massive momentum as a new vertical within the property landscape. Proptech, like Fintech, is an all-encompassing term to describe how startups are using innovative technology throughout any stage of the property life cycle or sector – including commercial, residential, renting, purchasing, leasing and more. Given the broad range of use cases PropTech covers, this piece will focus on the confluence of Proptech and data – specifically how you can use financial data to assist with multiple touch points involved in renting a residential property. With Australia facing a severe housing affordability crisis, paired with massive increases in house prices, there’s no better time to whip out the magnifying glass and zoom in on how data can assist with the tenant experience.

Before we begin

If you want to know more about Proptech and Open Banking, Basiq has its own Proptech guide that looks at a number of use cases outside of renting. Download it here

Renting into focus

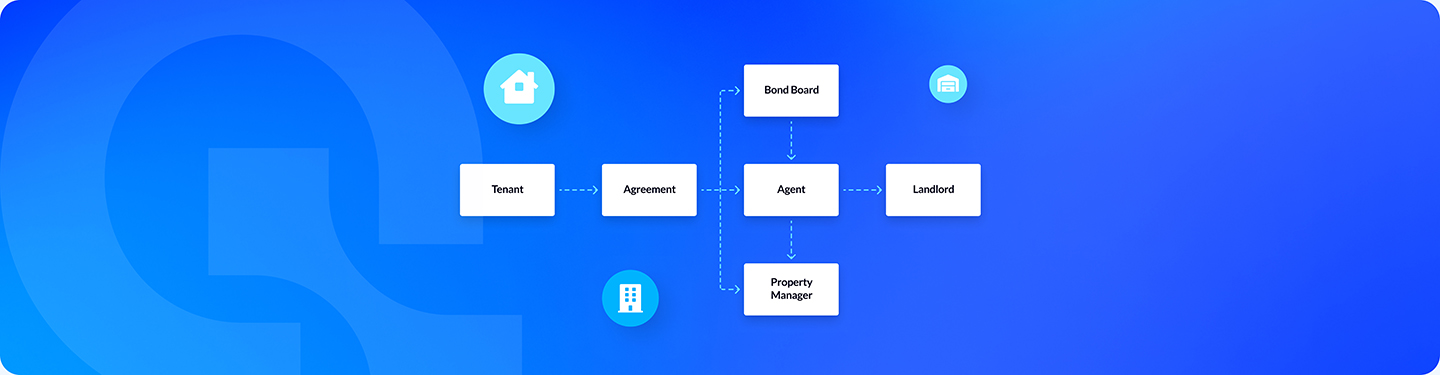

Renting a new house or apartment can be an arduous process. A renter’s touchpoint with data can be seen in the following process flow for finding a place to live:

- Applying for the property (rental application)

- Receiving an outcome (supporting documentation)

- Paying a bond and negotiating a Contract (payment and contract)

- Paying rent (payment)

- Ending the lease / giving notice (documentation)

Let’s use a hypothetical (NSW)

-> You apply for your perfect property via a property aggregator (e.g. Domain / REA) and if shortlisted, provide an array of supporting documentation via a separate portal

-> You are notified when you are approved, likely via phone or email

-> You negotiate, and execute a contract and pay a separate bond to the Rental Bond Board

-> You pay a monthly rental fee including 1 month up front via Direct Debit

-> You terminate your contract at the end of the period

-> Repeat steps 1-5 for a new property

There’s an overwhelming amount of data segregation in the above process. Not only are you storing information in multiple locations, but you are triggering and authorising payments from different accounts, as well as storing contractual obligations between multiple parties (the tenant, agent (sometimes landlord), NSW Govt and your flatmate).

Enter Open Banking

The above processes are steeped in both legacy and compliance. While important, we can glean the above situation through an Open Banking use case to see how the tenant experience can become seamless. Let’s return to the example:

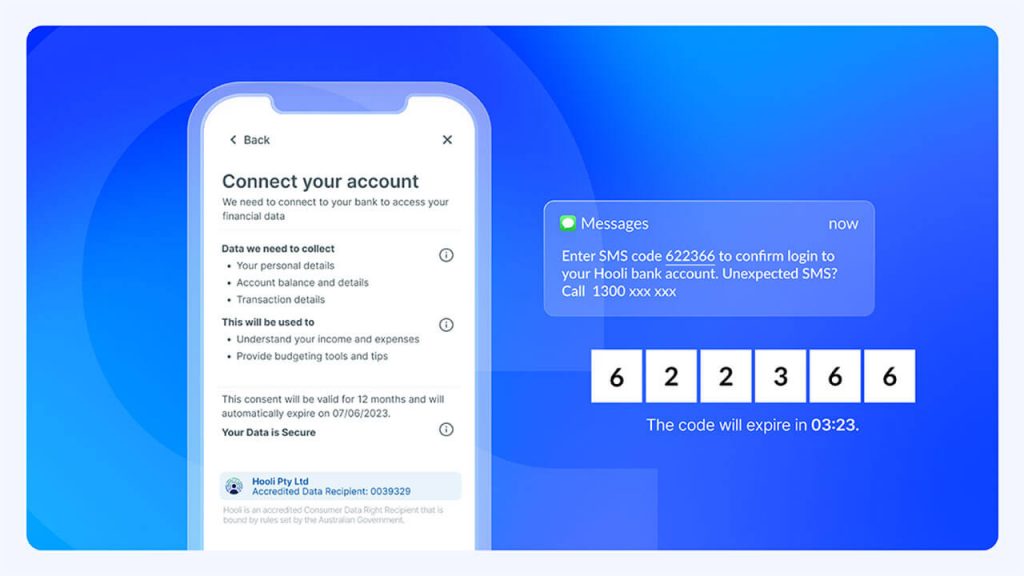

-> You provide your supporting documentation by connecting your Bank account which verifies your identity, confirms your income, previous pay amounts, affordability for the property and provides a result to the agency. As part of this sign up flow, you authorise the Direct Debit of the Bond to the NSW Govt, the rental fee within the same consent flow (with a user-defined date if you need your flatmate to top you up)

-> You provide any additional documentation, such as previous history and / or a reference – via an agent’s portal

-> You sign the contract between you and the agency

-> You terminate your contract between you and the agency when it’s complete

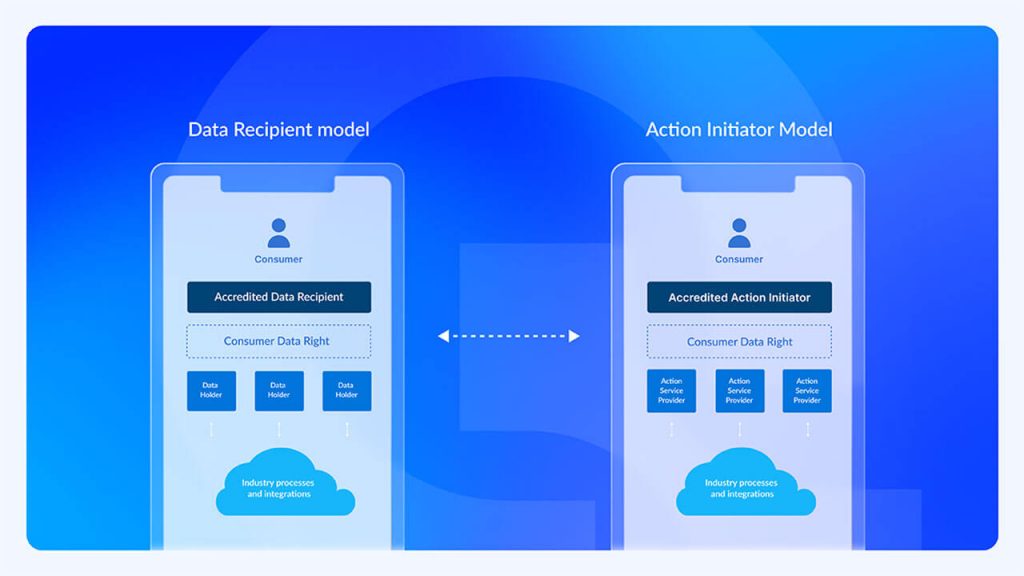

Within the even more exciting world of the Consumer Data Right (CDR), providing documentation such as previous history could be automated as the regime extends outside of Financial Services.

So, what’s just happened?

Through this sign up flow, a tenant has applied for their property by connecting their Bank account and supporting information to completely automate the application process. Via an integration such as Basiq, the time to submit an application is reduced significantly, even more so alleviating the likelihood of missed rental or bond payments through smart payments (see more on Open Banking payments). There are still manual processes involved, such as previous rental history, but the aforementioned evolution of CDR can assist with alleviating these headwinds.

The massive reduction in manual processing is self-evident. Not only do the rental portals greatly benefit from an increased ingestion of customer-consented financial data for verification and payroll / affordability, but direct debits can be automated and user-defined, and further disbursements to landlords can be automated through a sophisticated rules engine / workflow (eg an agent sets up a rule to disburse an amount to a landlord based on the amount defined by their portal – more on this in the next section).

What about the landlord?

Given renting is often a tripartite agreement, the process automation between a tenant and an agency is effective, however the landlord needs to be thrown into the mix. A landlord often receives funds that are disbursed manually from the agency into their account for the rental yield, less any monthly (or weekly / fortnightly) expenses incurred. The manual disbursement to the landlord (almost always via BSB/Acc No) could also be automated, by creating action-initiation triggers under the agency’s account to automatically disburse nominated amounts to the landlord’s account – such as creating a custom rule on behalf of the agency, or allowing the landlord to automatically Direct Debit (or mandate) a pull payment to the agency’s fund pool.

What other use cases are there?

This is one highly important yet nascent use case for Open Banking in the world of PropTech. Not only are we witnessing the confluence of data and tenants, but also data and payments. There’s no better time for Property technology companies to make use of the benefits of Open Banking. This is just one, extremely specific use case. The applications of data can go so much further: affordability for housing (the more traditional lending approach), solving the affordability crisis through platforms like ‘OwnHome’, automated deposits for fractional ownership of a home as an investment vehicle a la ‘BrickX’, approving ‘bond-now-pay-later’ schemes a la ‘TechLend’, and approving construction loans for renovators (and that’s just the residential space!).

I hope this was a beneficial insight into the many and varied applications of Open Banking data for Property Technology. There is so much more to talk about but so little time, so I look forward to extending the analogy for many use cases including commercial developments and even urban planning.

Article Sources

Basiq mandates its writers to leverage primary sources such as internal data, industry research, white papers, and government data for their content. They also consult with industry professionals for added insights. Rigorous research, review, and fact-checking processes are employed to uphold accuracy and ethical standards, while valuing reader engagement and adopting inclusive language. Continuous updates are made to reflect current financial technology trends. You can delve into the principles we adhere to for ensuring reliable, actionable content in our editorial policy.