For many, June 30 is an annual milestone loaded with stress and confusion. Not only are the rules and regulations around tax law continually changing, but many individuals don’t know their financial position until it’s time to lodge their tax return.

For companies, accounting software has made it easy to keep tabs on their tax position. But for individuals, self-managing their taxes has been clunky, time-consuming and clouded in uncertainty.

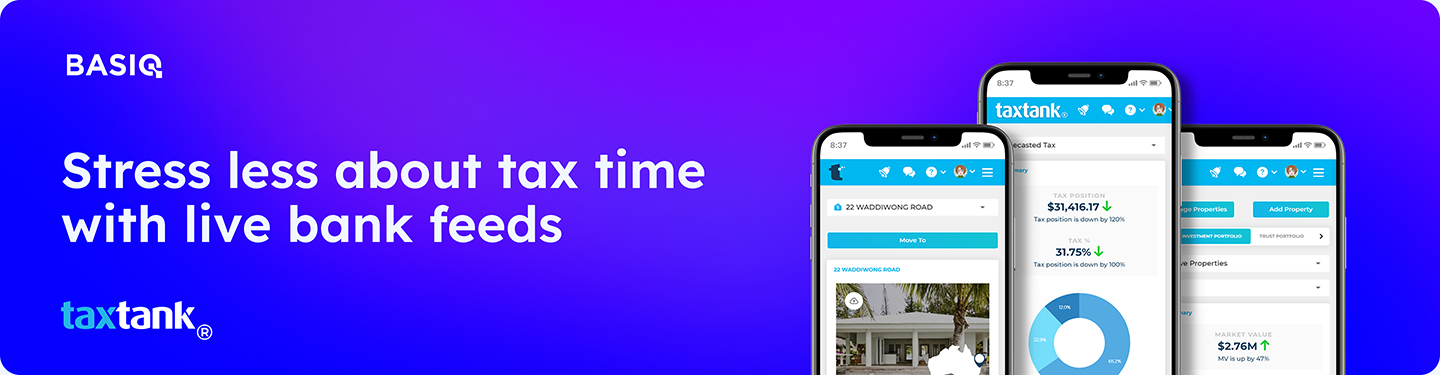

That’s exactly what TaxTank is on a mission to solve. TaxTank is a low-cost, cloud-based software helping to simplify tax for everyday Australians.

Loaded with smart tax tools and automated bank feeds powered by Open Banking, TaxTank makes it easy to maximise deductions, minimise tax and reduce end-of-financial-year stress for property investors, sole traders and individual taxpayers.

What is TaxTank?

At its core, TaxTank aims to help individuals make informed financial decisions ahead of tax time. The software is cloud-based and low-cost (starting at just $6 per month), packed with features designed to make self-managing income, assets, expenses and overall financial position stress-free.

For founder and Gold Coast-based tax specialist Nicole Kelly, the platform champions a fairer, more transparent tax system for individuals.

Amidst the ever-increasing cost of ATO scrutiny, TaxTank was born from the belief that tax simply cannot be a once-a-year event and be effective. There had to be a better way to improve compliance whilst still making tax simple to manage, easy to understand and hassle-free for everyday Australian taxpayers.

To achieve this, TaxTank empowers customers with the tools they need to plan, manage and simplify their tax affairs in real-time.

Nicole Kelly, Founder of TaxTank says, “working as a CPA and taxation specialist for nearly 10 years, I would see client after client struggling to keep on top of their tax affairs. At tax time it’s a mad rush to consolidate expenses while spending hours searching for receipts to substantiate any deductions for the past year.”

“We wanted to develop a platform that gives the individual taxpayer the ability to not only manage their taxes more effectively but provides a transparent view of their real-time tax and financial position, 365 days a year. This gives the individual and those working with an accountant the opportunity to identify and take advantage of additional tax saving opportunities before the financial year ends,” Nicole added.

TaxTank uses a range of ‘tanks’ or digital containers that store different parts of an individual’s information:

- Work Tank manages work-related income using live bank feeds, along with storing receipts for work-related expenses.

- Property Tank keeps tabs on an investor’s properties and portfolios to monitor the cash, tax and equity positions.

- Sole Tank is designed to help sole traders manage their income, with invoicing and reporting tools, too.

- Holdings Tank is designed to manage investors’ stocks, shares and cryptocurrencies, keeping tabs on their portfolio’s value and any gains or losses they’ve made.

- Spare Tank is a secure storage area for paperwork, receipts and deduction information.

What sets TaxTank apart is its focus on real-time data, keeping individuals informed about their financial position all year round. Rather than spending hours at tax time collating documents and nervously submitting their return, the platform provides up-to-date tax summaries to save them both time and money and enable better decision-making.

Committed to building a platform that solves the real-world tax problems of everyday Australians, TaxTank surveyed over 33,200 people to find out what features mattered most to them.

Here’s what they’ve delivered:

- Real-time reporting with detailed, interactive tax position reports and forecasts.

- Live bank feeds that offer real-time tax position summaries.

- Secure document storage for receipts, statements and warranties (making a shoebox of faded receipts a thing of the past).

- Simple, smart and automated depreciation tools to maximise tax benefits without the hassle.

- Smart property value forecasting using CoreLogic’s industry-leading insights (perfect for property investors).

- Automate tax position estimates and recommendations for ways to maximise deductions.

The result? TaxTank makes it easy for individuals to claim everything they’re entitled to, while ensuring they’ve got the right records to back up their claims with the ATO. The platform even produces a comprehensive range of tax reports, including the myTax report, allowing users or their accountants to lodge their tax returns with speed and confidence.

Solving tax time stress with smart tax tools

For individuals, lodging their tax returns often comes with fear and uncertainty. Will they receive the sizable refund they were hoping for, or will they be hit with a large, unexpected tax bill?

Plus, the process can take hours out of their week as individuals scramble to gather invoices, receipts and documents from the past 12 months. For many, forking out hundreds (if not thousands) of dollars on an accountant is the only way to get this process sorted.

But with TaxTank’s smart tax tools, individuals can self-manage their tax affairs with confidence. The platform offers travel logbooks, capital gains tax calculators, home office logbooks, depreciation calculators and more to help Australians make informed decisions all year round (not just when lodging their tax return).

Harnessing live bank feeds, powered by Open Banking

TaxTank is pioneering a new way of approaching tax management, the first platform in Australia to tap into bank feeds (powered by Open Banking) gives taxpayers real-time access to their financial position.

While live bank feeds are commonly used for business accounting software, individuals have been forced to tackle the process of gathering receipts and lodging their returns manually.

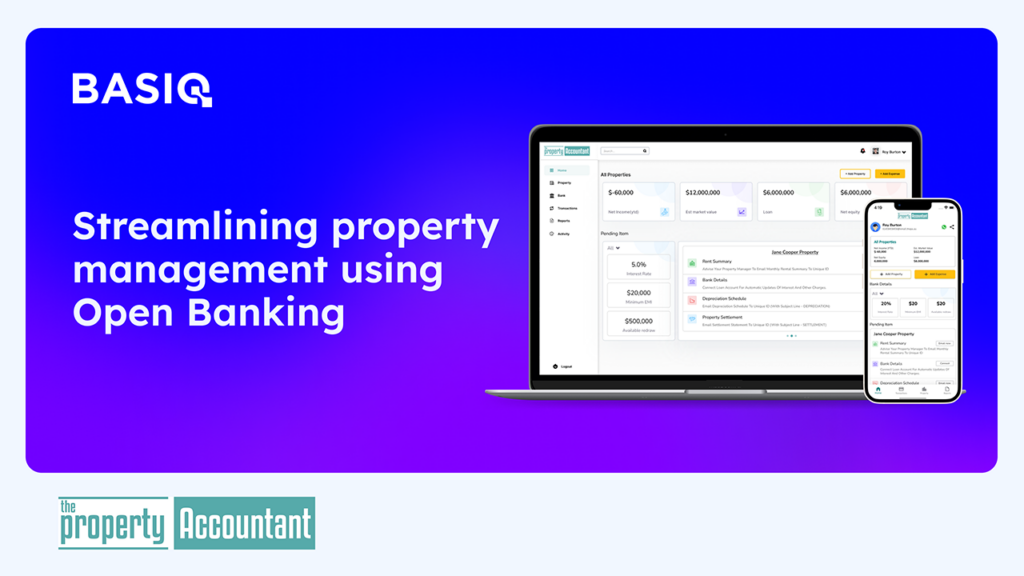

How TaxTank and Basiq work together

By harnessing Open Banking and Basiq’s Connect and Enrich products, TaxTank harnesses live bank feeds to run its entire platform. This live, standardised and categorised data gives individuals the ability to ensure they’re claiming everything they’re eligible for as a tax deduction (lowering the chance of human error or missing valuable deductions).

Allocating loans and overdrafts to properties also enables a real-time overview of equity, interest rates and accurate growth forecasts over time for informed decisions without the guesswork.

Here’s how it works:

- TaxTank requests customer consent to access live bank feeds via Basiq’s Consent UI

- Customer accepts or declines permission

- If consent is given, Basiq contacts the customer’s bank

- Customer bank returns the requested bank data using Basiq’s Connect and Enrich products.

- They are ready to roll! Every time a customer logs on their live bank feeds are automatically connected, ready for use on the TaxTank platform – until consent is withdrawn or expires.

It’s never been more important for individuals to have a watertight record-keeping system for tax-related receipts and documents. In fact, changes to tax legislation now mean the ATO is laser-focused on preventing fraudulent activity among investment property owners.

These recent changes mean the ATO is now able to access bank transactions related to these properties to compare them with an individual’s tax declaration).

For individuals, gaining access to live bank feeds through TaxTank is a game-changer, giving them clear oversight of their records and financial position well ahead of tax time.

The future of smarter tax-time decision-making

TaxTank is passionate about leveraging Open Banking to revolutionise the way individuals manage their finances.

To date, individuals have had few options when it comes to proactively preparing for tax time. Large accounting firms have come with high price tags and have been moving away from working with individuals, instead focusing on more lucrative ongoing partnerships with businesses.

Powered by live bank feeds, TaxTank’s software makes accounting and tax support accessible to everyone, from sole traders to individual taxpayers and even property investors.

Individuals can allocate just 10 minutes a week to reviewing transactions and uploading receipts (rather than spending hours scrambling to gather their records at tax time). Plus, there are serious cost savings for taxpayers, in particular investors, who can score upwards of a 60% cost saving by using TaxTank to self-manage throughout the year and engaging TaxTank’s specialist team of virtual accountants to review and lodge painlessly at tax time.

With the ability to review their financials at any time, forecast potential tax scenarios and pinpoint deduction opportunities, individuals are better placed to take control of their finances (which is becoming increasingly important in today’s turbulent economic climate).

Find out more about TaxTank and how they’re helping individuals manage their tax and financial position with ease.

TaxTank is accessing Open Banking via the Basiq platform. Interested in learning more? Get in touch with our team.

Article Sources

Basiq mandates its writers to leverage primary sources such as internal data, industry research, white papers, and government data for their content. They also consult with industry professionals for added insights. Rigorous research, review, and fact-checking processes are employed to uphold accuracy and ethical standards, while valuing reader engagement and adopting inclusive language. Continuous updates are made to reflect current financial technology trends. You can delve into the principles we adhere to for ensuring reliable, actionable content in our editorial policy.