Basiq, the API platform powering some of Australia’s most innovative fintechs with access to financial data, today announced Basiq 3.0, a significant upgrade to its platform to become Australia’s first true Open Finance platform, through a single API.

Basiq 3.0 – Open Finance platform

The Basiq 3.0 platform helps deliver a more complete picture of end-users, minimising complexity by providing a single access point for access to multiple data sources. Not only does Basiq 3.0 access the Consumer Data Right (CDR) data with Open Banking, the platform can also access data through web capture for financial institutions that are not yet part of Open Banking. It’s future-proofed to access data outside the financial services sector that will be available as the CDR progresses, including Telcos, Utilities, Insurance and more.

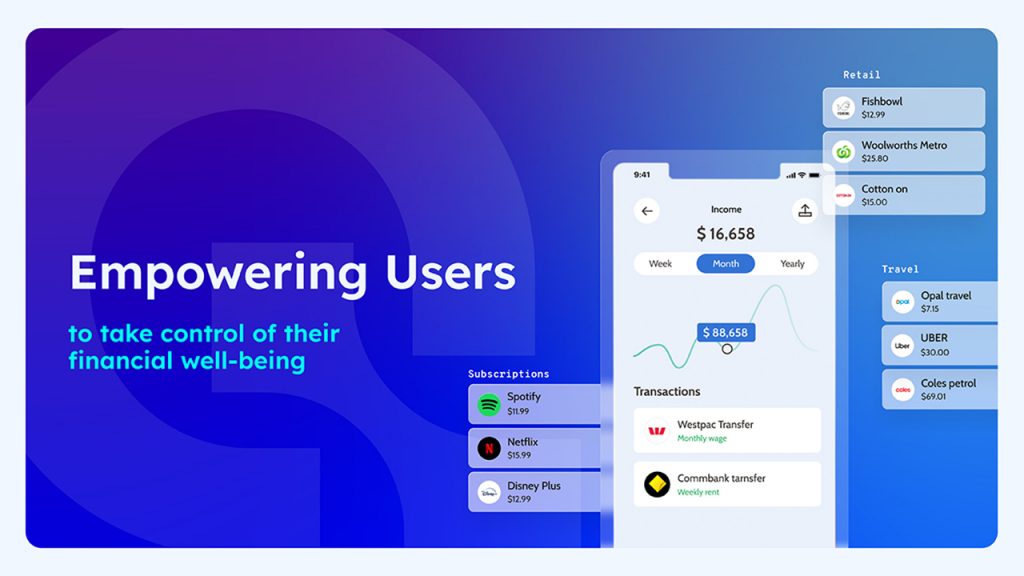

“Open Finance is the critical next step up from Open Banking; it represents an opportunity to obtain a statement of financial position from current and future consumers. Fintechs can incorporate data from various sources, including superannuation providers, BNPL services, non-ADI data, payments, wealth management, insurance providers and more.

Through our platform, we’re excited to deliver best in class services that enable fintechs to develop personalised experiences, ensuring their customers have leading solutions to manage their finances. The use of the Basiq platform continues to grow into new segments and with the developments in Open Finance, this will only continue to accelerate. ”

Damir Ćuća, CEO and Founder

With Basiq 3.0, a new consent management capability has been launched that ensures a consistent approach to how data is managed and used. The new capability is aimed at ensuring fintechs can operate in a compliant way to deliver value to consumers, whilst empowering consumers to have full control over the use of their data.

What’s new in Basiq 3.0

The upgrades to the platform with Basiq 3.0 include:

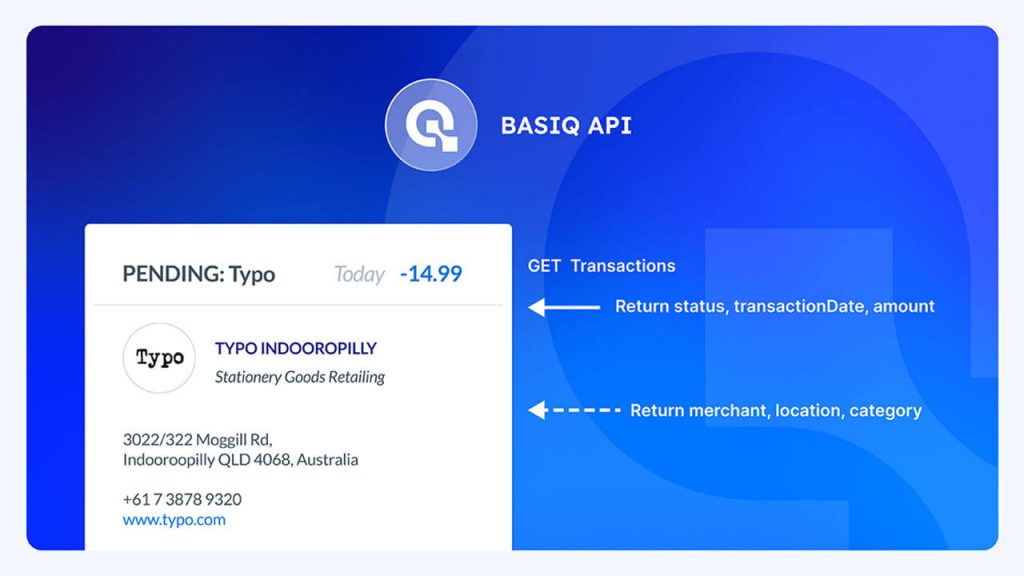

- Data sources: The ability to consume data from a variety of sources, including banking, superannuation, BNPL and card issuers, through different methods, all via a single API.

- CDR access: Access to all data holders with Open Banking and the ability to consume data from future segments under the CDR.

- Consent management: Ability to define consent policies, UI, data use and duration for each application across all data sources.

- Data governance: Fully managed data governance solution to conform to data rules including anonymisation, deletion and notification of consent changes

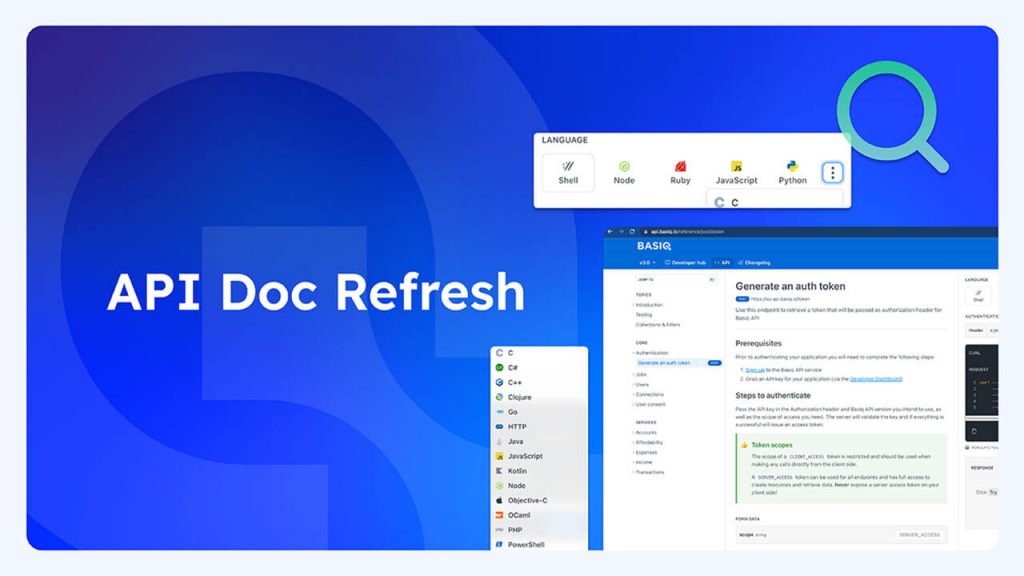

- Developer hub: New tools to help the developer journey including extensive API docs, quickstart guides, starter kits and a sandbox environment to test financial data and integration.

Learn more about Open Finance

Open Finance provides the ability for any organisation to offer financial services products to their consumers. Basiq 3.0 has taken away the complexity in accessing and using financial data. Find out more about Basiq 3.0 at our latest virtual event via the video below where you’ll hear about the latest on the Basiq platform, industry trends & insights to help you propel your business into the future.

About Basiq

At Basiq, our vision is Making Finance Easy. Finance is complex and it can be hard for consumers to make informed financial decisions. We see a world where consumers are empowered to make smarter financial decisions and to engage with their finances in new and unique ways.

Basiq enables this by providing an Open Finance API platform for businesses to build innovative financial solutions. As the building blocks of financial services, the platform facilitates the relationship between businesses and consumers by enabling access to consented financial data and payments services.

Basiq is part of the Cuscal Group.

Article Sources

Basiq mandates its writers to leverage primary sources such as internal data, industry research, white papers, and government data for their content. They also consult with industry professionals for added insights. Rigorous research, review, and fact-checking processes are employed to uphold accuracy and ethical standards, while valuing reader engagement and adopting inclusive language. Continuous updates are made to reflect current financial technology trends. You can delve into the principles we adhere to for ensuring reliable, actionable content in our editorial policy.