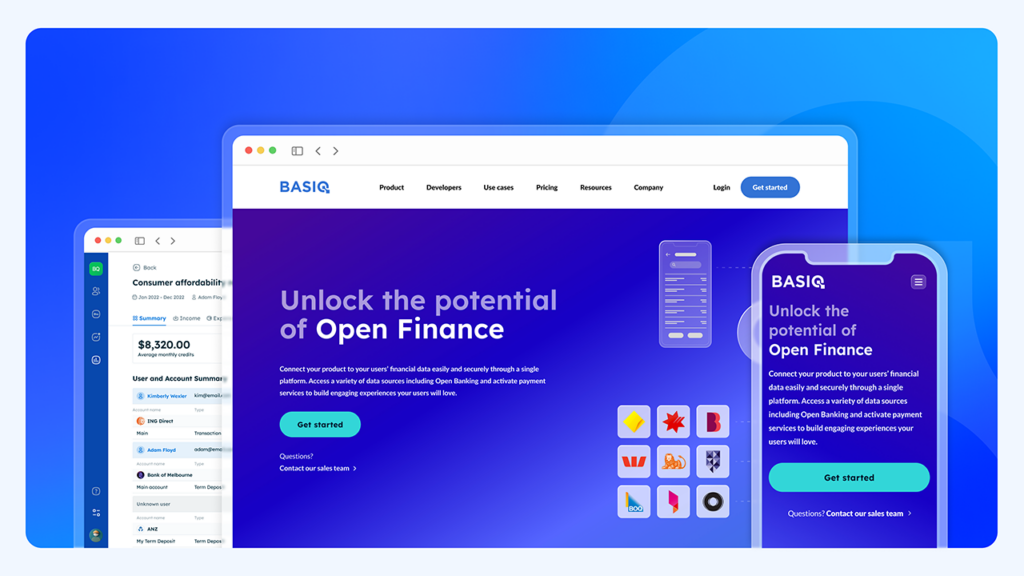

1.3 million connections by December: insider data reveals Open Banking success

Basiq, a leading data aggregator, has released a new report, Changing Perspectives: An inside look at Open Banking performance and adoption in Australia, detailing critical findings on the performance and growth of Open Banking in Australia.

Shannon Rennie

July 4, 2024 • 3 minute read