Proptech

Use financial data & insights in proptech

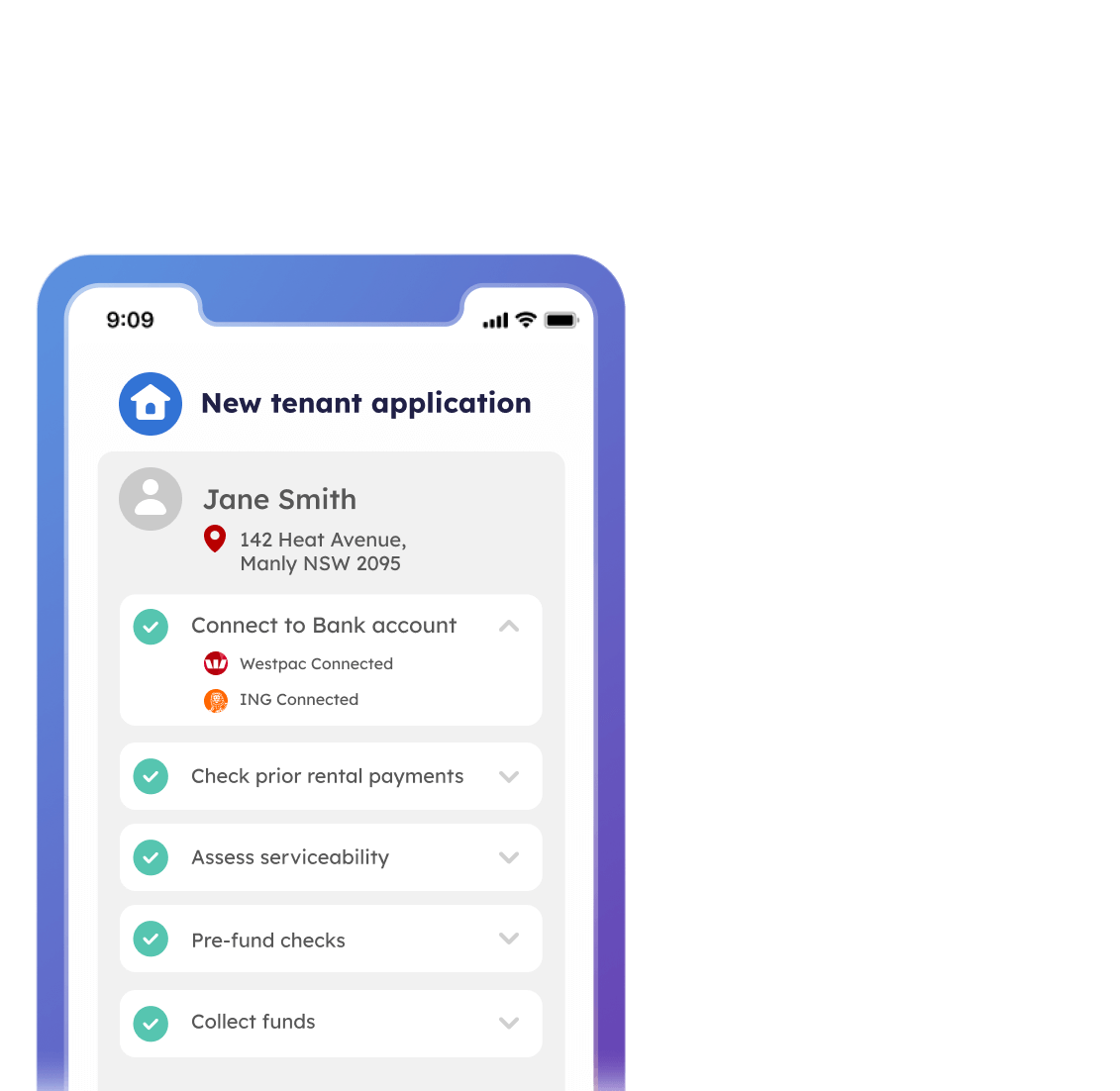

Access financial data to provide a more seamless experience for tenants through the rental lifecycle. Uncover insights to easily conduct rental serviceability, automate payments and help eliminate payment dishonours.