Collections

Optimise overdue payment collection & debt recovery

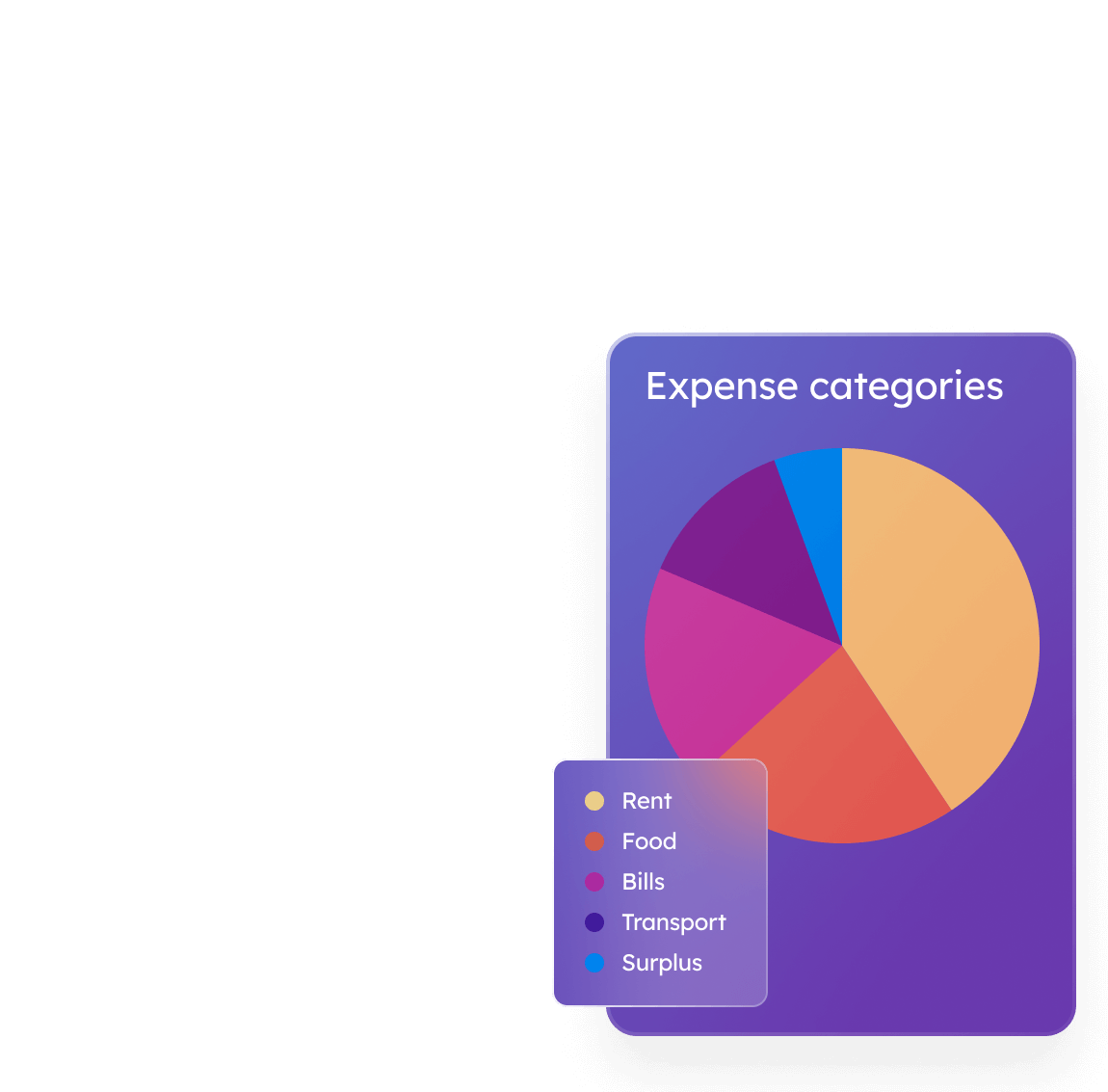

Utilise financial data and smart payments to optimise the collection of overdue payments and debt. Eliminate missed payments and establish tailored plans to assist customers in repaying outstanding debt.