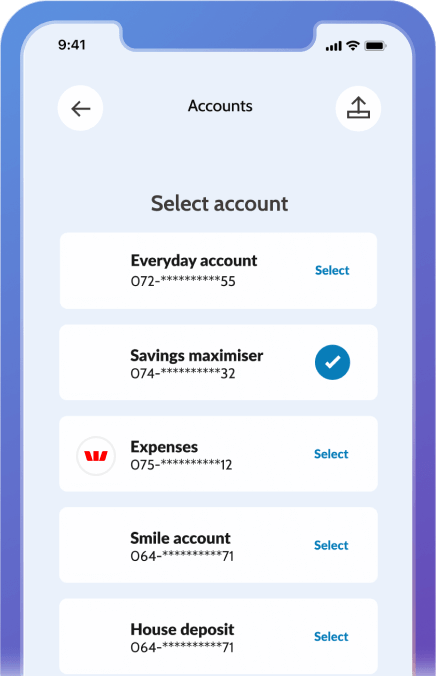

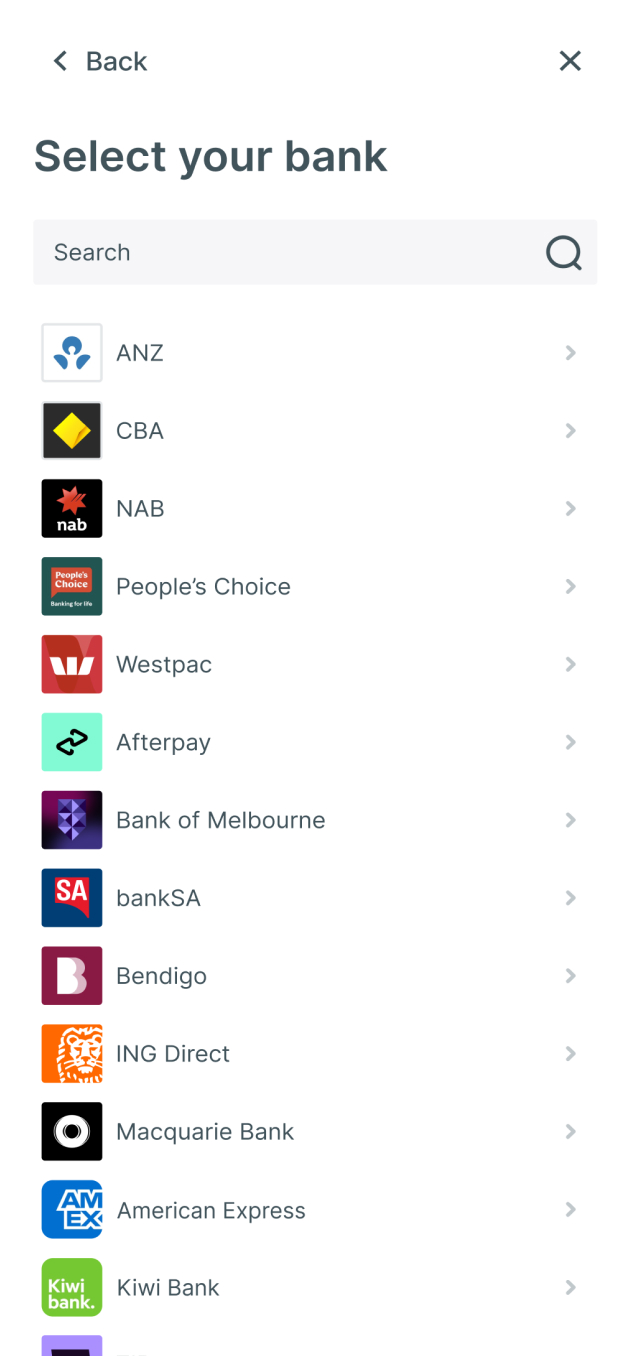

Account verification

Use the Basiq platform to instantly verify bank accounts, assist with KYC/AML and mitigate risk for a seamless user experience.

Dive into the account verification guide to understand the difference between common account verification methods, where they fall short and see why leveraging the Basiq platform provides a faster, safer and seamless experience for your customers.

View Guide