Wealth & Investing

Help customers grow their wealth

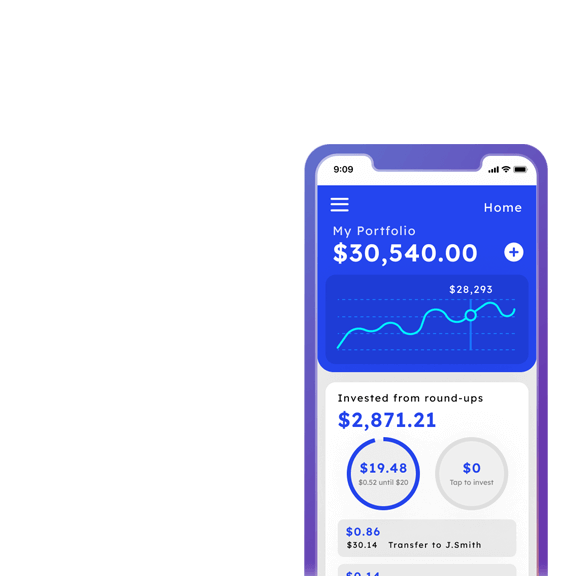

Enable your customers to easily onboard by connecting and verifying their financial accounts. Generate a holistic view of their finances to provide financial advice and leverage capabilities such as roundups and automated payments for micro-investments.