Not-for-profits

A smarter way to donate

Create new avenues for customers to donate on a regular basis to their NFP of choice. Use financial data and smart payments to optimise donations while creating an engaging and rewarding experience for users.

Create new avenues for customers to donate on a regular basis to their NFP of choice. Use financial data and smart payments to optimise donations while creating an engaging and rewarding experience for users.

The Basiq platform provides access to data and insights to optimise the Donation experience,

enabling you to focus on creating unique value for your customers

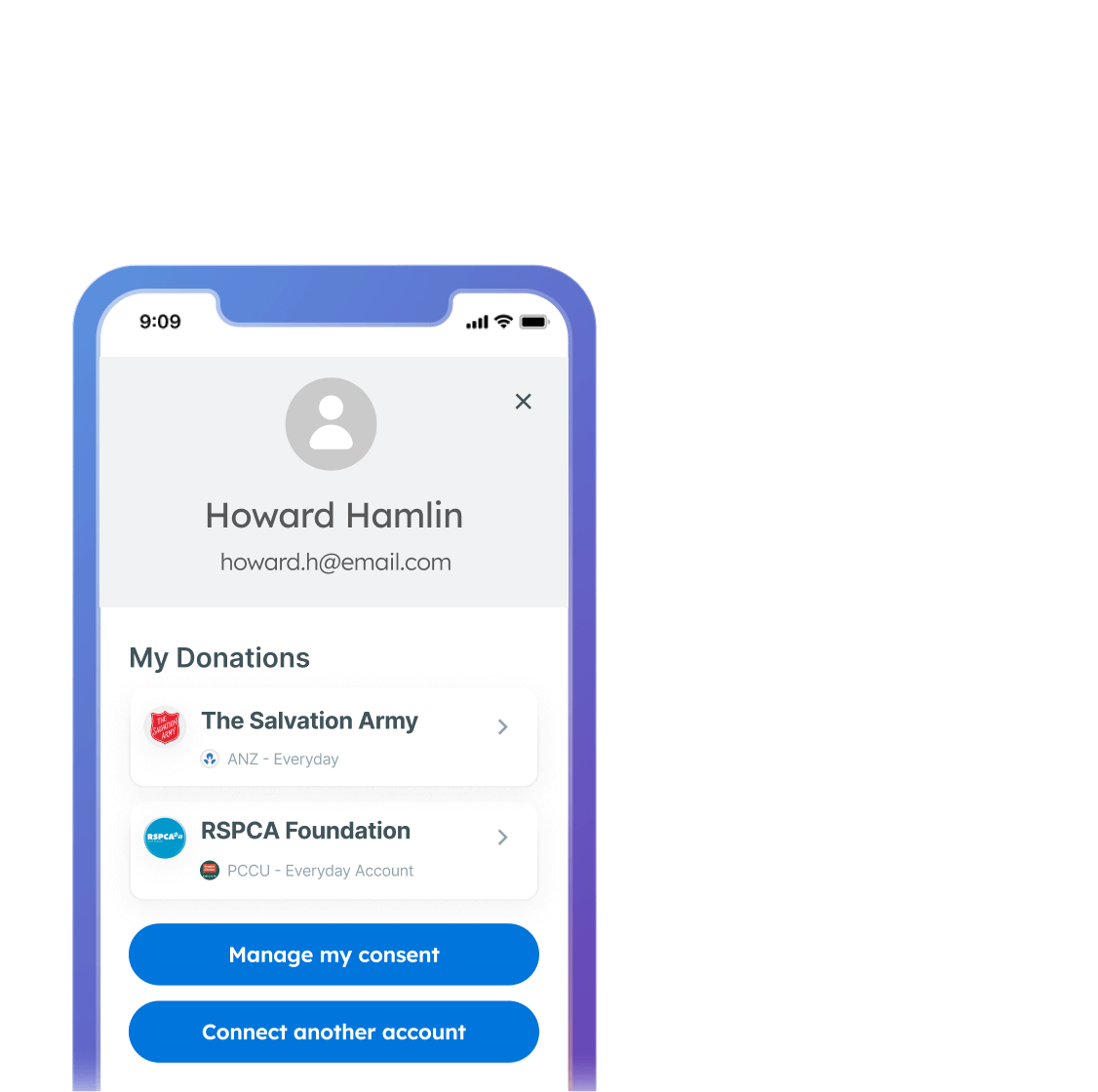

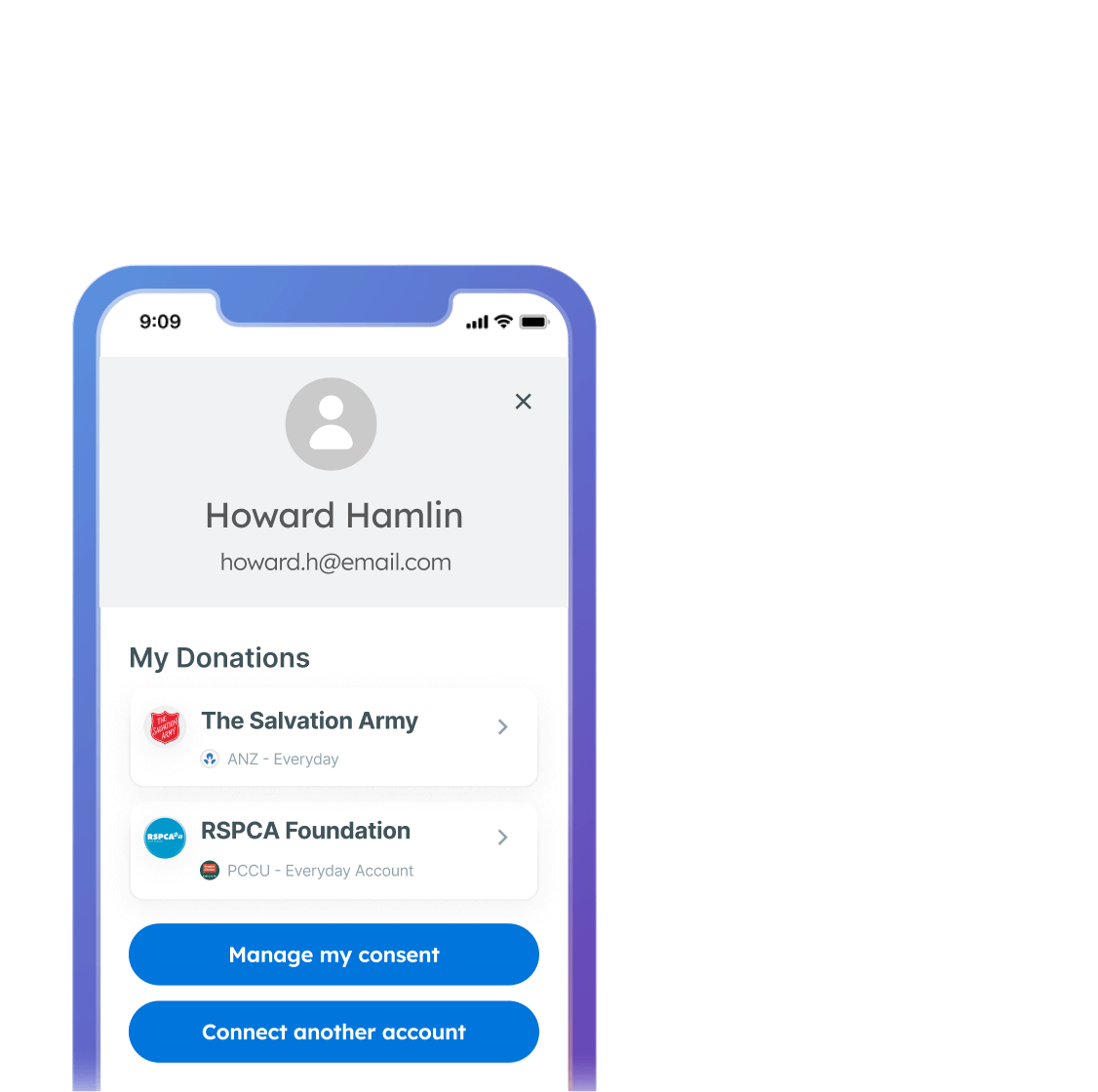

Seamlessly onboard users and ensure donations are processed from the right account by verifying bank account details such as Name, BSB and Account number.

Mr David Baller, 15 Bendigo Drive, Cartwright NSW

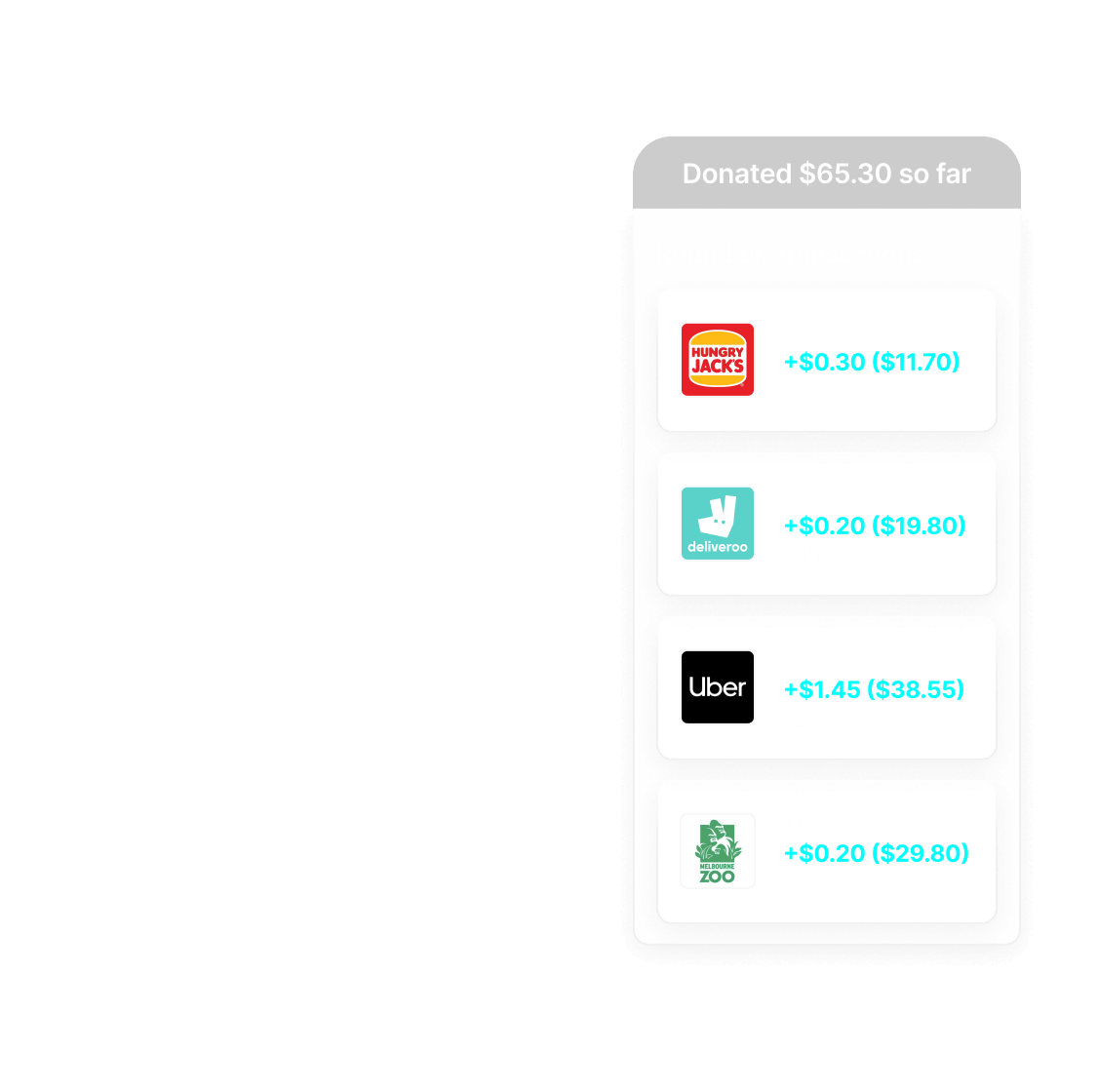

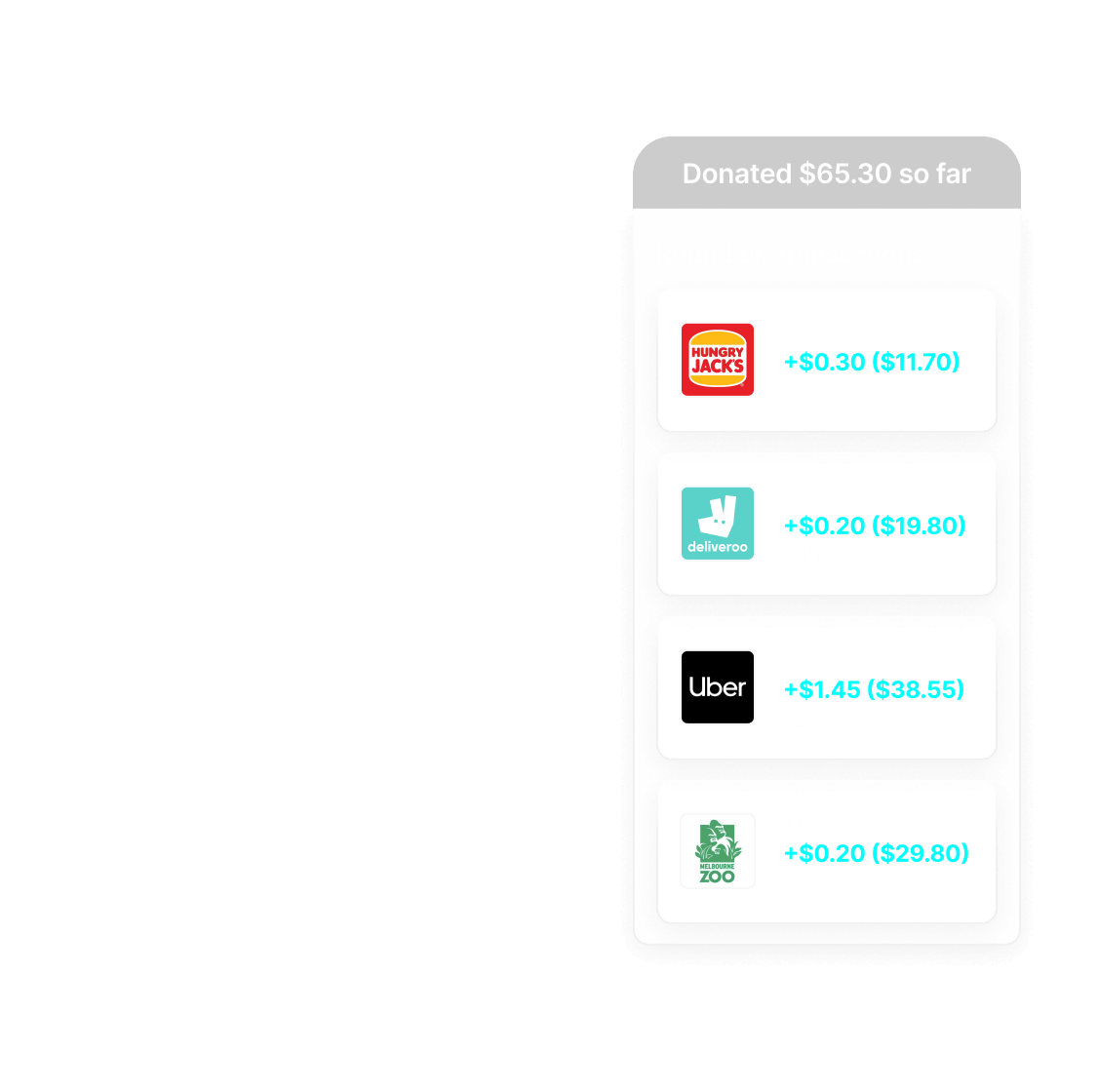

Enable users to round up specific types of transactions to donate smaller amounts on a regular basis. Provide the flexibility to donate a % or set amount once their regular income arrives or when their account balance reaches a nominated threshold.

Maximise the success of donations by conducting pre-fund checks to ensure there are sufficient funds prior to processing payment. Take proactive steps to communicate with donors to ensure a smooth customer experience.

Read more“The integration of Basiq into the GoGive infrastructure has been a very pleasurable experience, a well-rounded API with an amazing technical support team, I couldn’t have dreamt of a better experience.”

Alex Desbiez, CEO

Get in touch with one of our team members or create an account