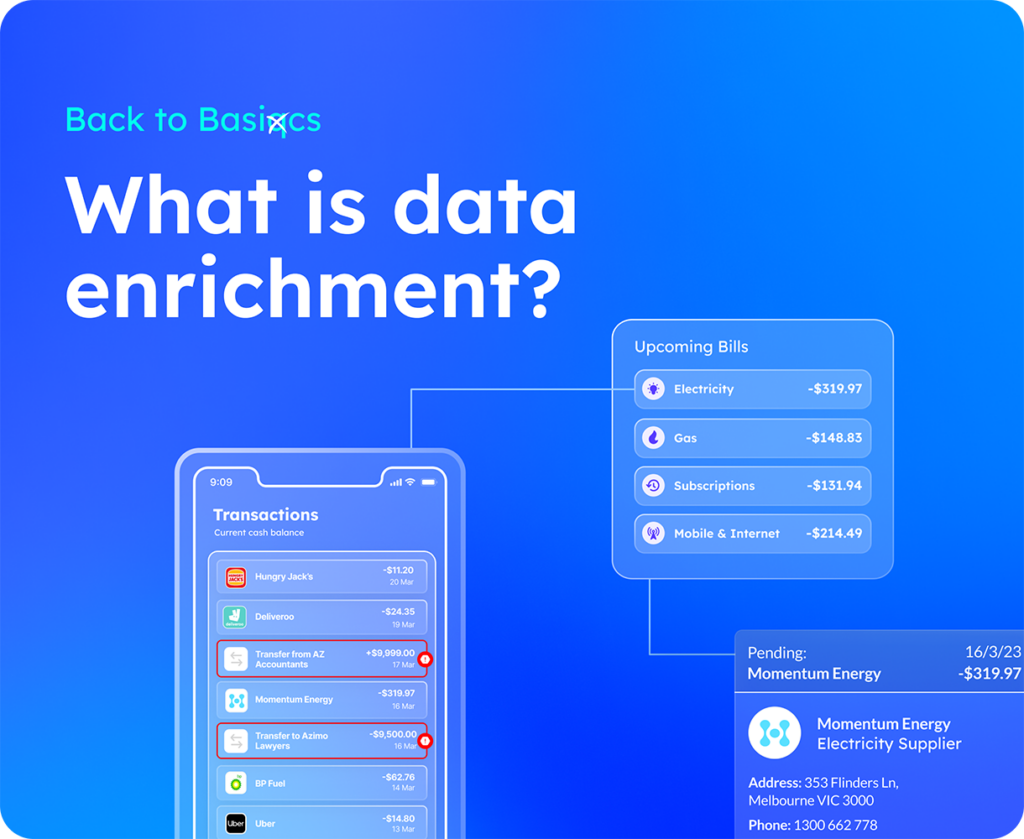

Back to basics: What is data enrichment?

Basiq Enrich transforms raw banking data into insightful information through a four-step process including data access, cleaning, enrichment, and machine learning, aiming for high accuracy in transaction categorisation and enrichment.

Alex McManus

April 18, 2024 • 3 minute read